menu

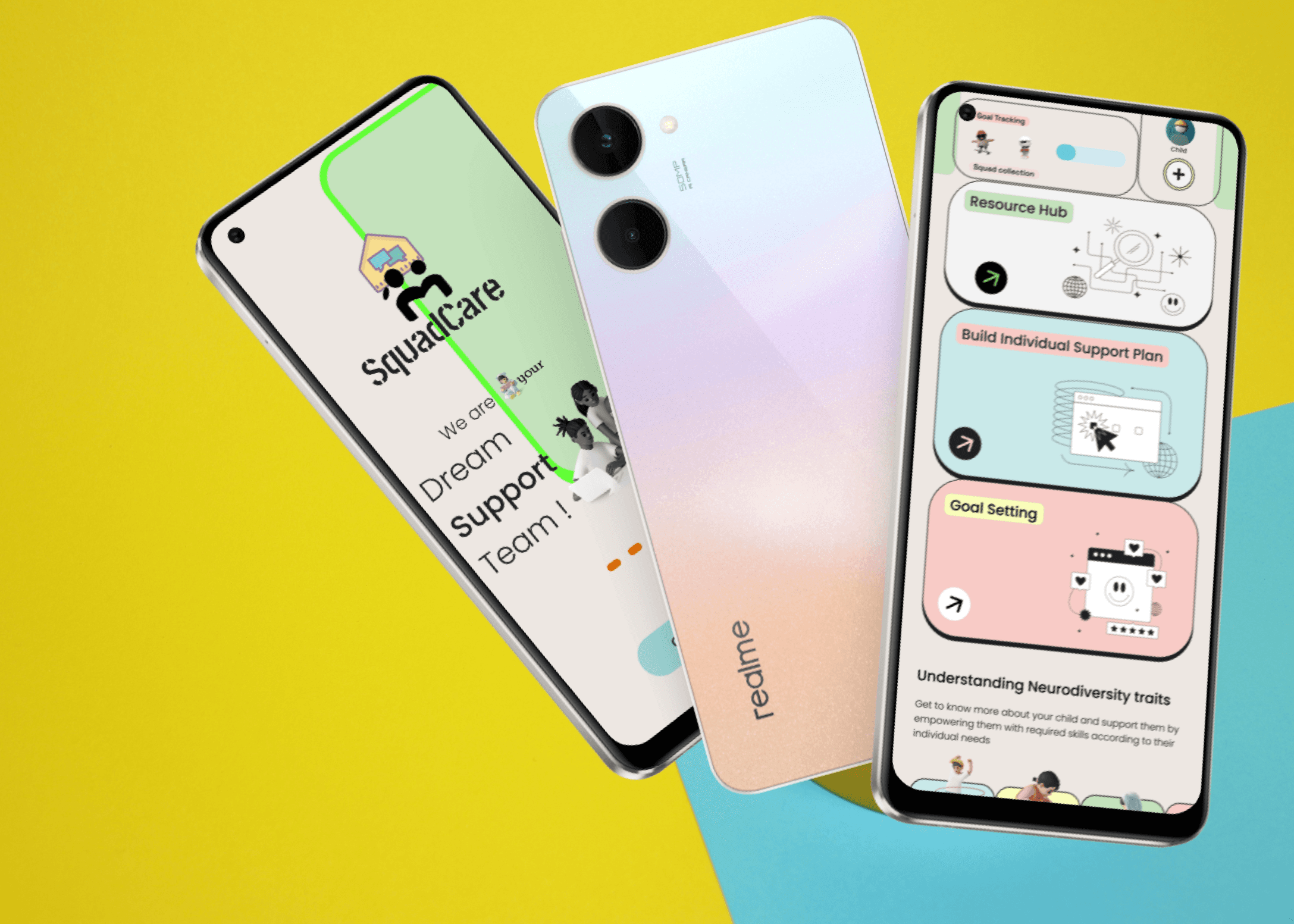

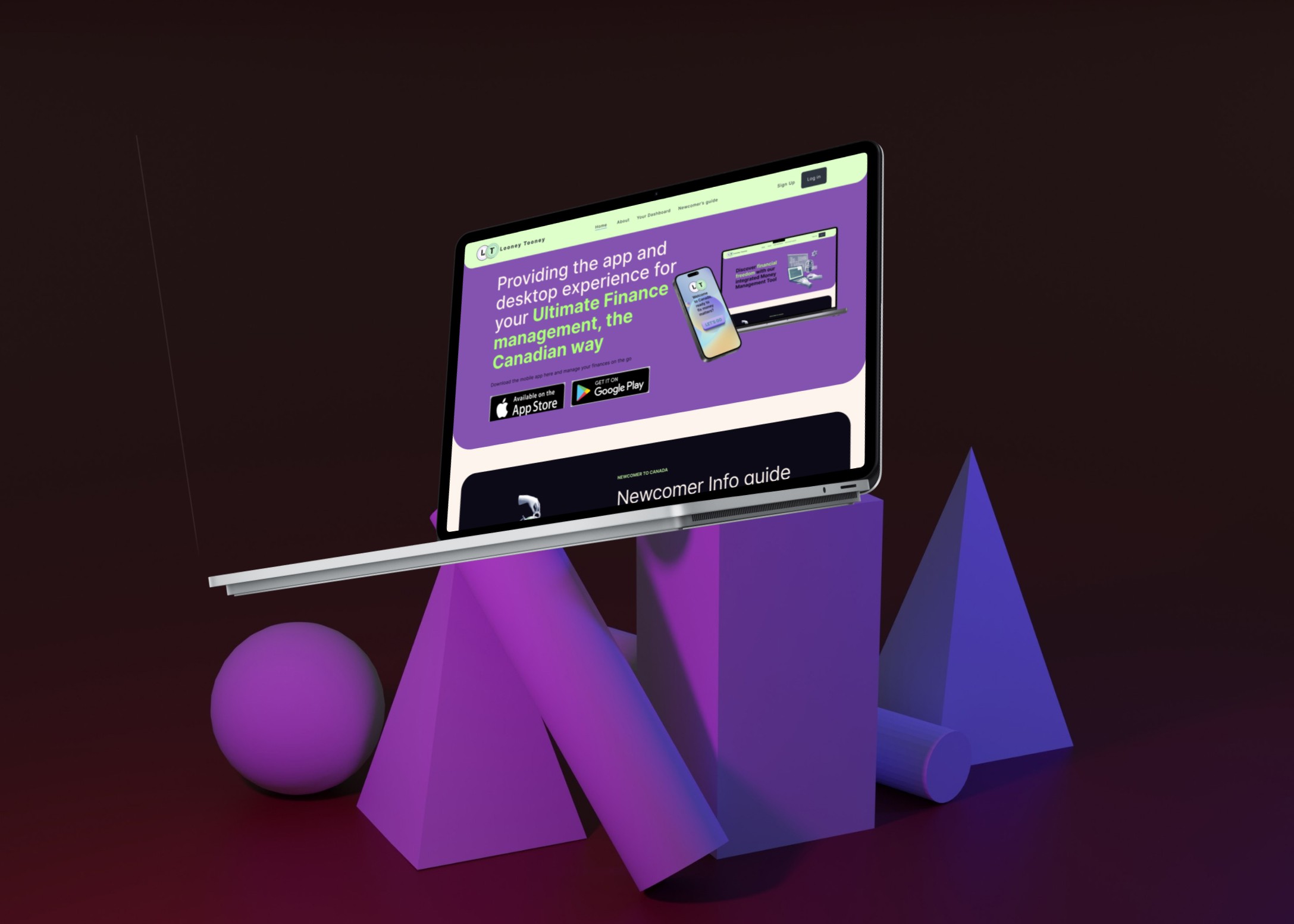

looneytooney - financial app for immigrants to Canada

looneytooney - financial app for immigrants to Canada

looneytooney - financial app for immigrants to Canada

looneytooney - financial app for immigrants to Canada

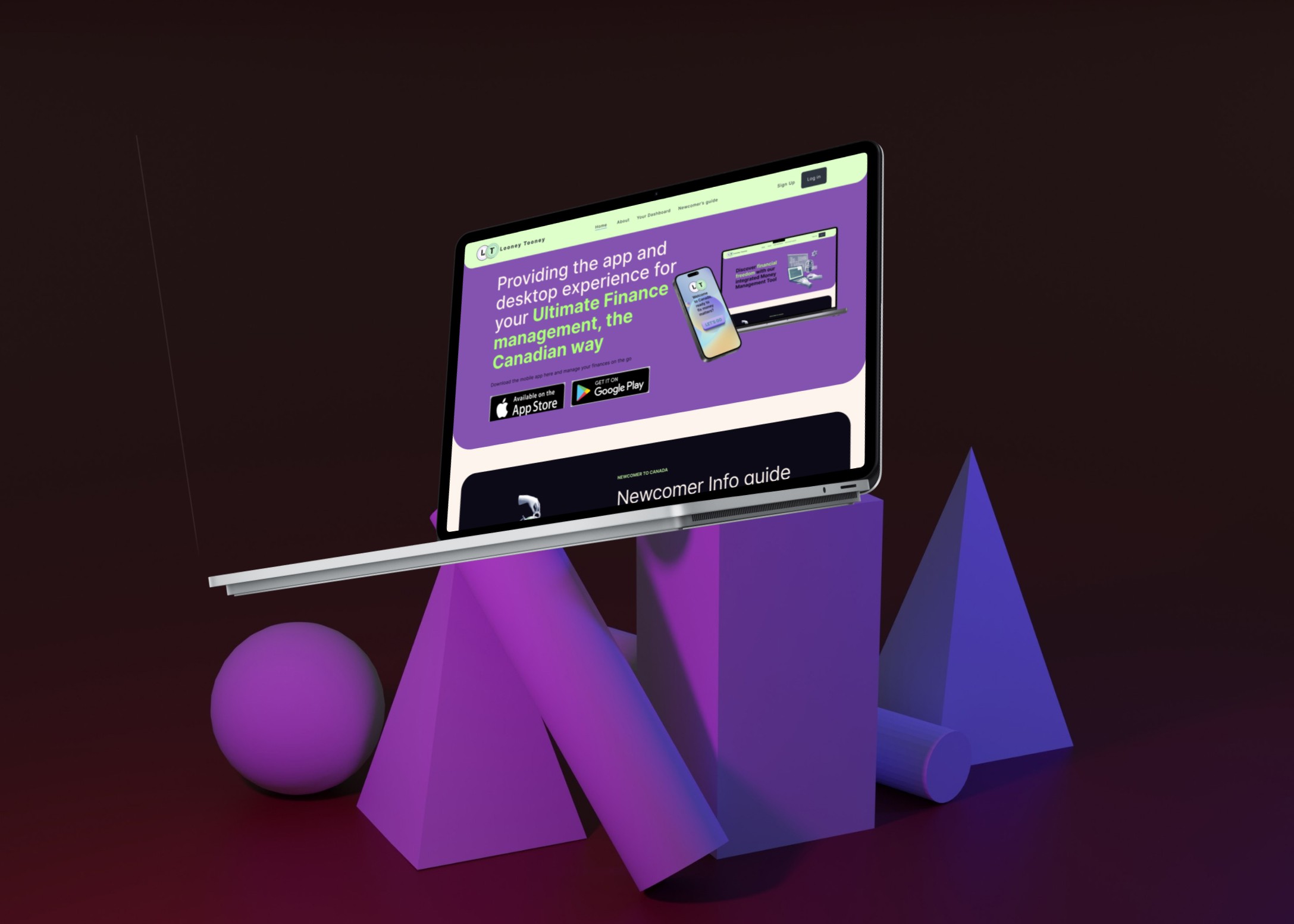

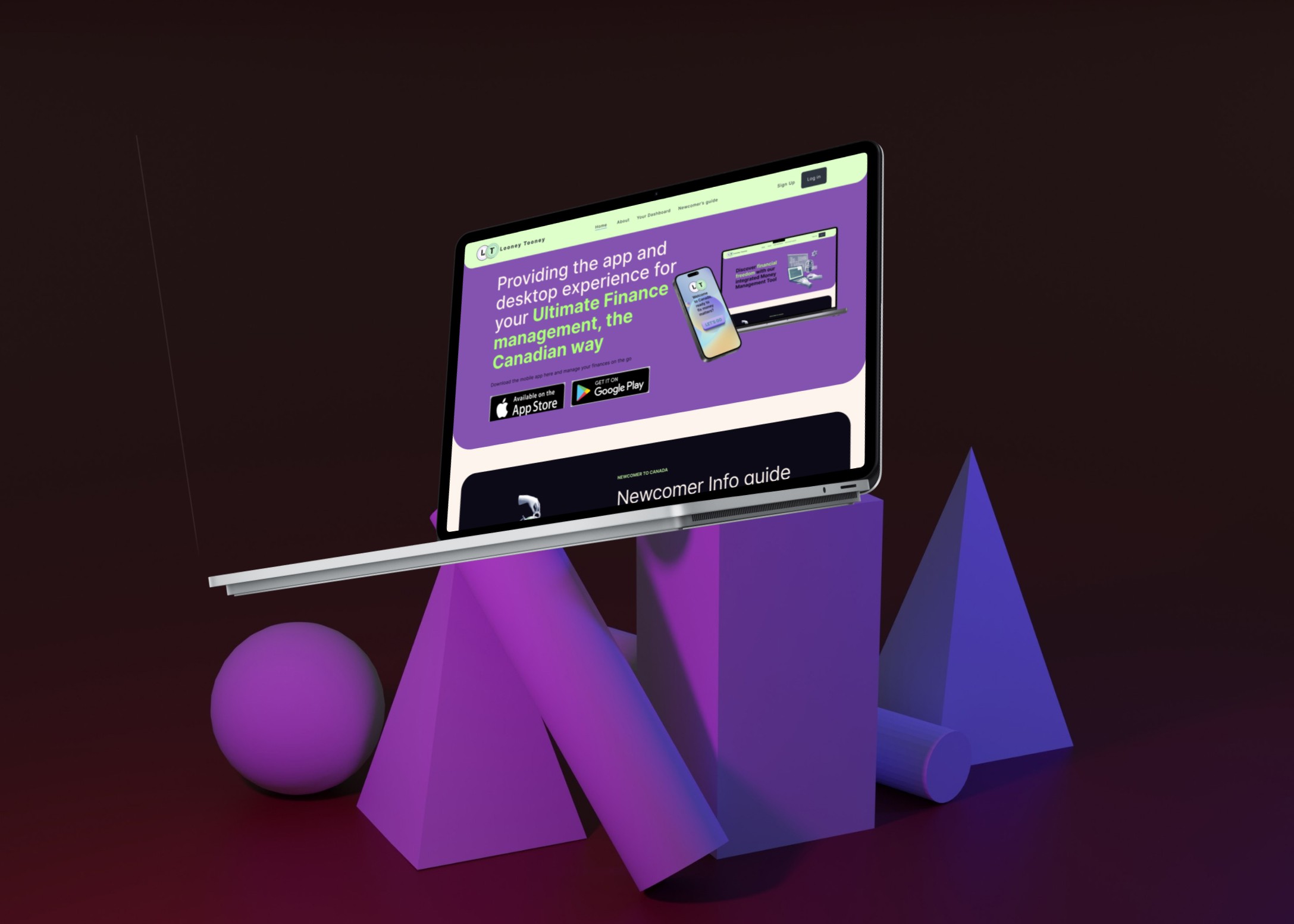

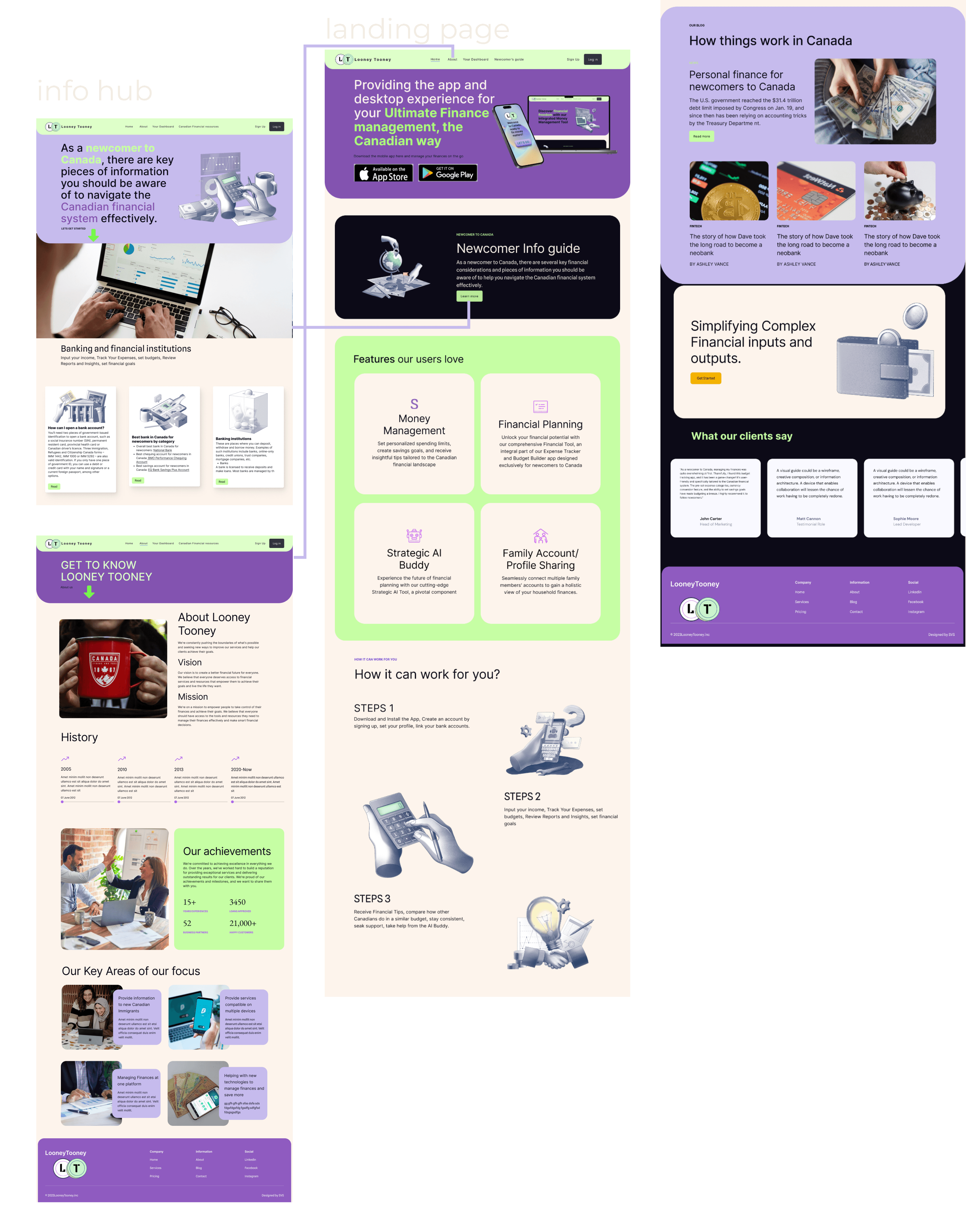

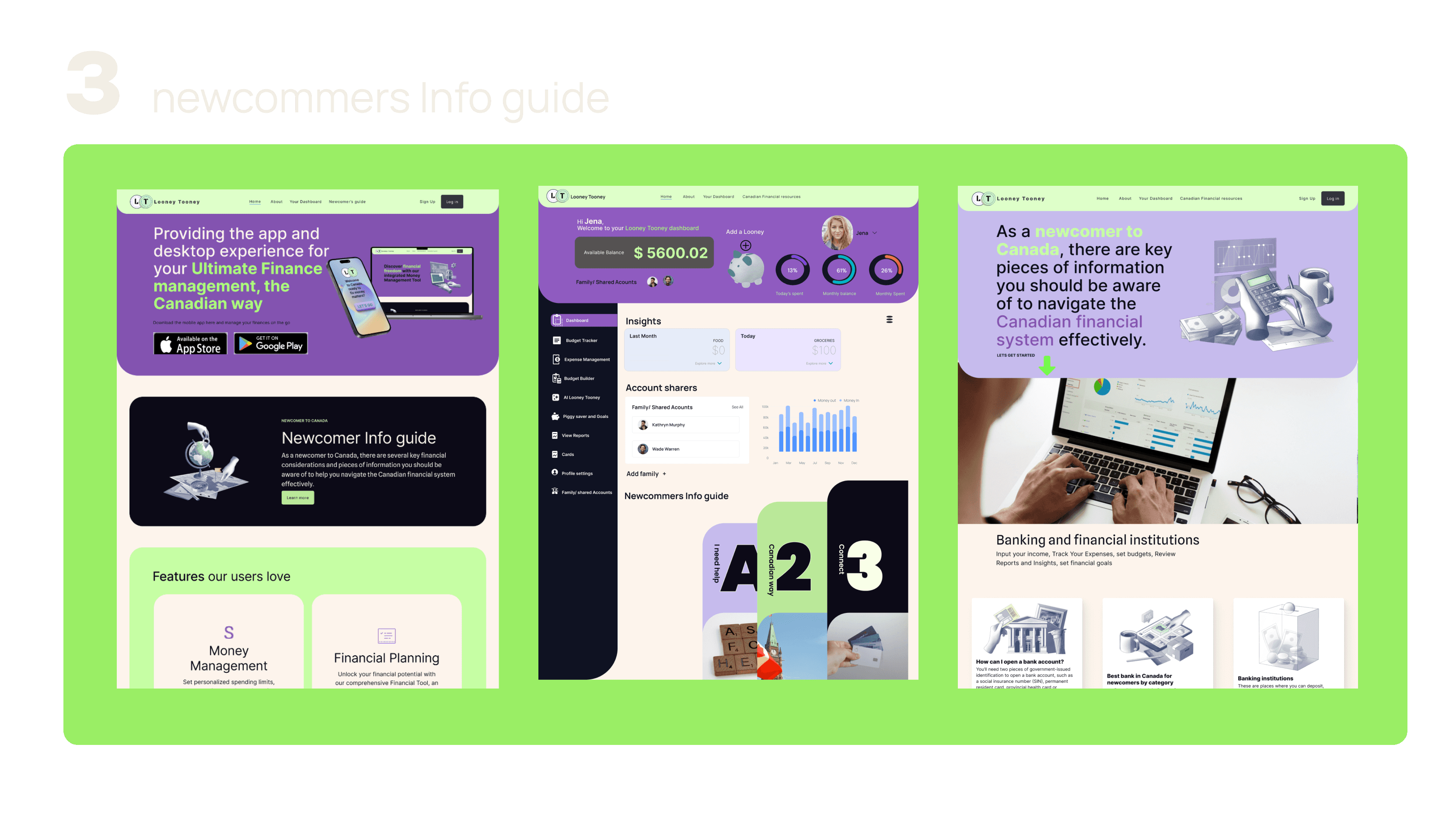

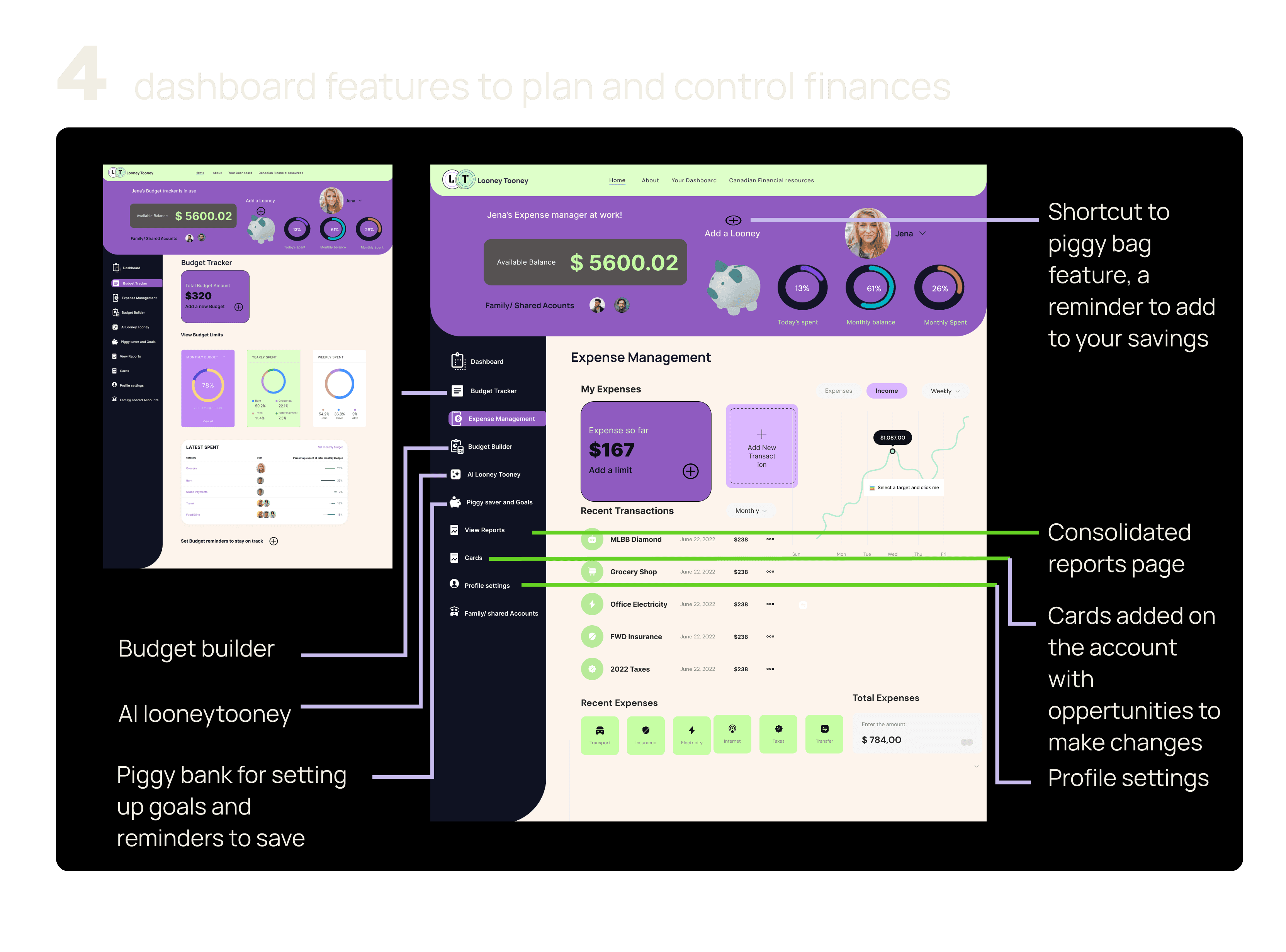

newcomers to Canada need "looney tooney" to manage their finances and gain financial literacy. it's an integrated financial tracking system and an info hub for newcomers to Canada, which provides expense tracking, budget building in the new country, and get to learn about the existing financial institutes and best practices once in Canada.

newcomers to Canada need "looney tooney" to manage their finances and gain financial literacy. it's an integrated financial tracking system and an info hub for newcomers to Canada, which provides expense tracking, budget building in the new country, and get to learn about the existing financial institutes and best practices once in Canada.

newcomers to Canada need "looney tooney" to manage their finances and gain financial literacy. it's an integrated financial tracking system and an info hub for newcomers to Canada, which provides expense tracking, budget building in the new country, and get to learn about the existing financial institutes and best practices once in Canada.

newcomers to Canada need "looney tooney" to manage their finances and gain financial literacy. it's an integrated financial tracking system and an info hub for newcomers to Canada, which provides expense tracking, budget building in the new country, and get to learn about the existing financial institutes and best practices once in Canada.

00

00

00

00

problem

Newcomers to Canada face significant challenges in accessing vital information about Canadian financial institutions and often find it difficult to navigate the intricacies of managing their finances in a new environment. There is a pressing need for a solution to help newcomers track their expenses, navigate the intricacies of the Canadian financial landscape, and work towards their financial goals to settle better in a new country. Constraints: shared accounts, security concerns, and the evolving landscape of open banking pose additional constraints that must be addressed in developing such a solution.

solution

How might we empower newcomers to Canada to confidently track their expenses, manage their finances, and stay informed about the diverse financial offerings in Canada? "Create an integrated financial tracking system accessible on both mobile and desktop platforms, offering essential information and guidance to assist newcomers in achieving their financial objectives"

problem

Newcomers to Canada face significant challenges in accessing vital information about Canadian financial institutions and often find it difficult to navigate the intricacies of managing their finances in a new environment. There is a pressing need for a solution to help newcomers track their expenses, navigate the intricacies of the Canadian financial landscape, and work towards their financial goals to settle better in a new country. Constraints: shared accounts, security concerns, and the evolving landscape of open banking pose additional constraints that must be addressed in developing such a solution.

solution

How might we empower newcomers to Canada to confidently track their expenses, manage their finances, and stay informed about the diverse financial offerings in Canada? "Create an integrated financial tracking system accessible on both mobile and desktop platforms, offering essential information and guidance to assist newcomers in achieving their financial objectives"

problem

Newcomers to Canada face significant challenges in accessing vital information about Canadian financial institutions and often find it difficult to navigate the intricacies of managing their finances in a new environment. There is a pressing need for a solution to help newcomers track their expenses, navigate the intricacies of the Canadian financial landscape, and work towards their financial goals to settle better in a new country. Constraints: shared accounts, security concerns, and the evolving landscape of open banking pose additional constraints that must be addressed in developing such a solution.

solution

How might we empower newcomers to Canada to confidently track their expenses, manage their finances, and stay informed about the diverse financial offerings in Canada? "Create an integrated financial tracking system accessible on both mobile and desktop platforms, offering essential information and guidance to assist newcomers in achieving their financial objectives"

problem

Newcomers to Canada face significant challenges in accessing vital information about Canadian financial institutions and often find it difficult to navigate the intricacies of managing their finances in a new environment. There is a pressing need for a solution to help newcomers track their expenses, navigate the intricacies of the Canadian financial landscape, and work towards their financial goals to settle better in a new country. Constraints: shared accounts, security concerns, and the evolving landscape of open banking pose additional constraints that must be addressed in developing such a solution.

solution

How might we empower newcomers to Canada to confidently track their expenses, manage their finances, and stay informed about the diverse financial offerings in Canada? "Create an integrated financial tracking system accessible on both mobile and desktop platforms, offering essential information and guidance to assist newcomers in achieving their financial objectives"

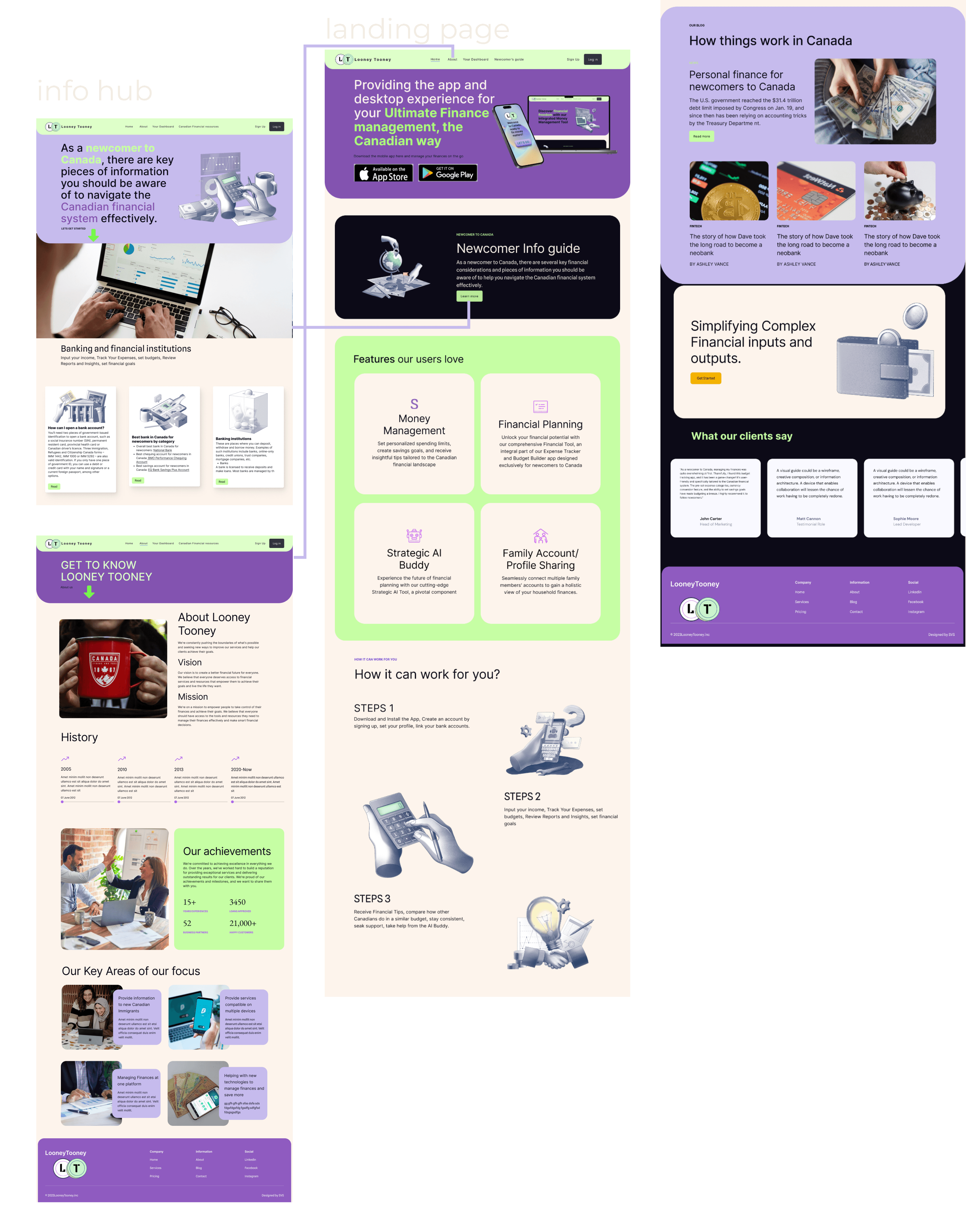

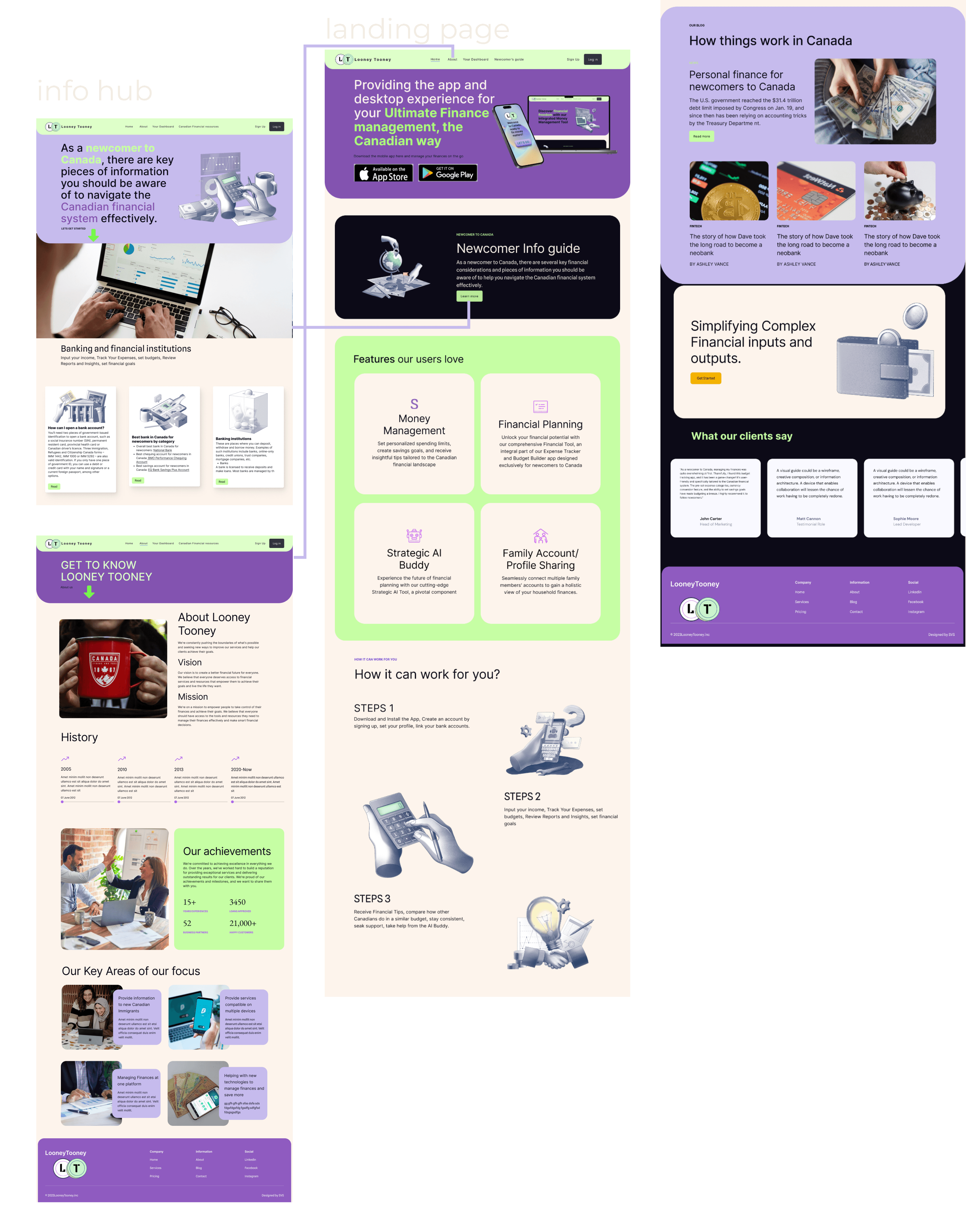

An innovative web and mobile application designed to cater to the specific needs of newcomers to Canada. A comprehensive, user-friendly platform that combines information, financial management, and community support to help newcomers transition smoothly into their new lives in Canada.

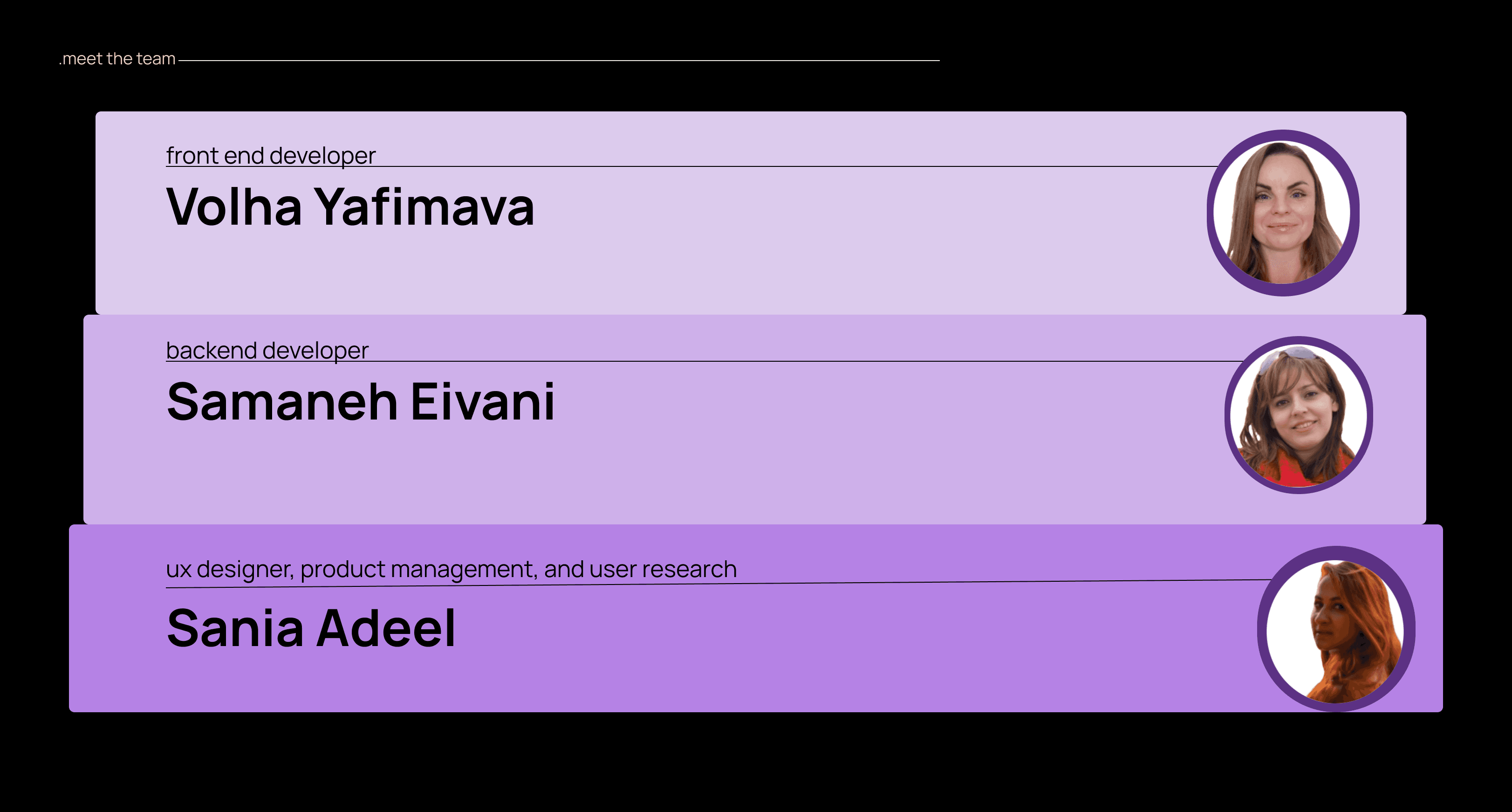

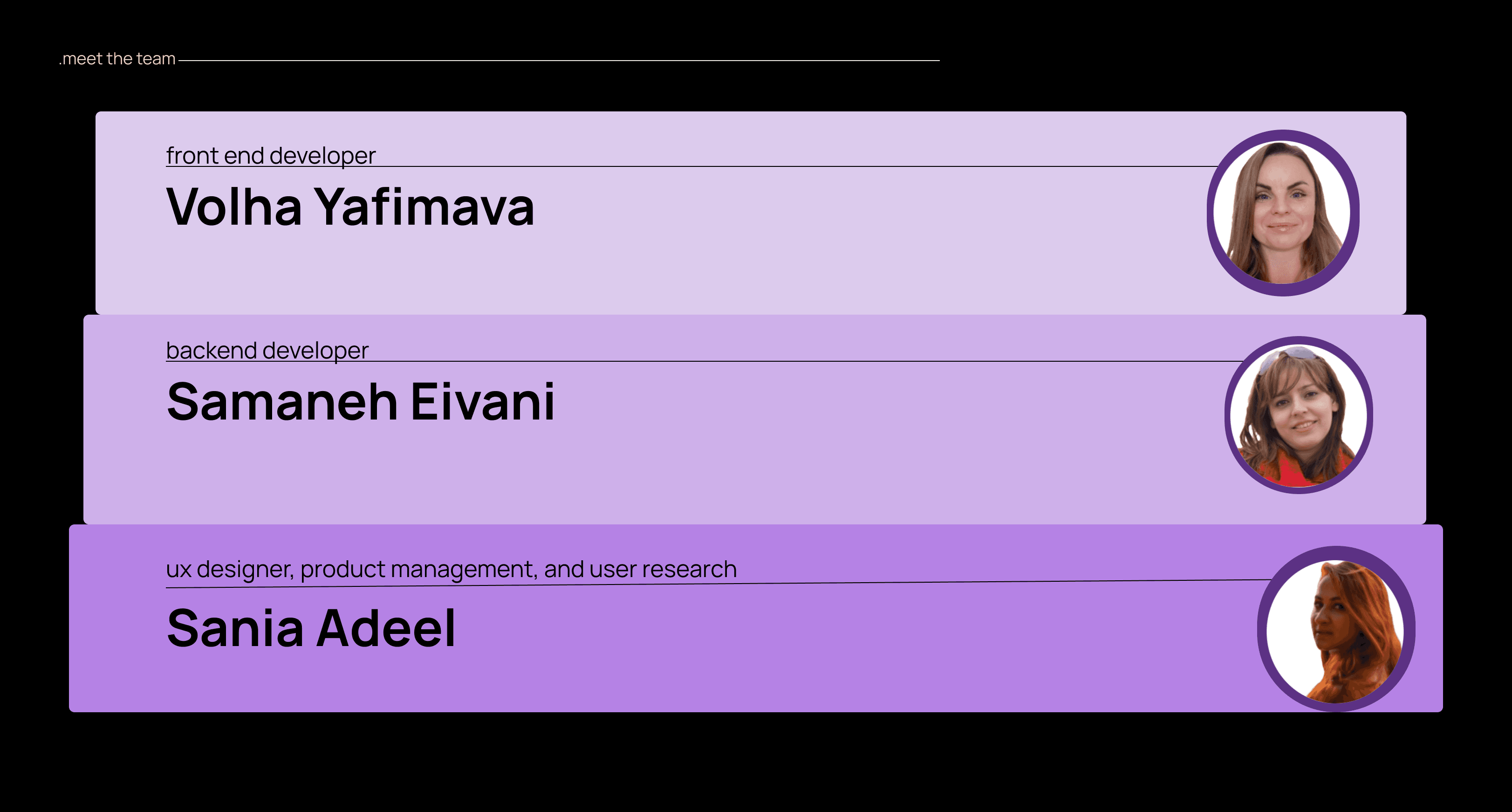

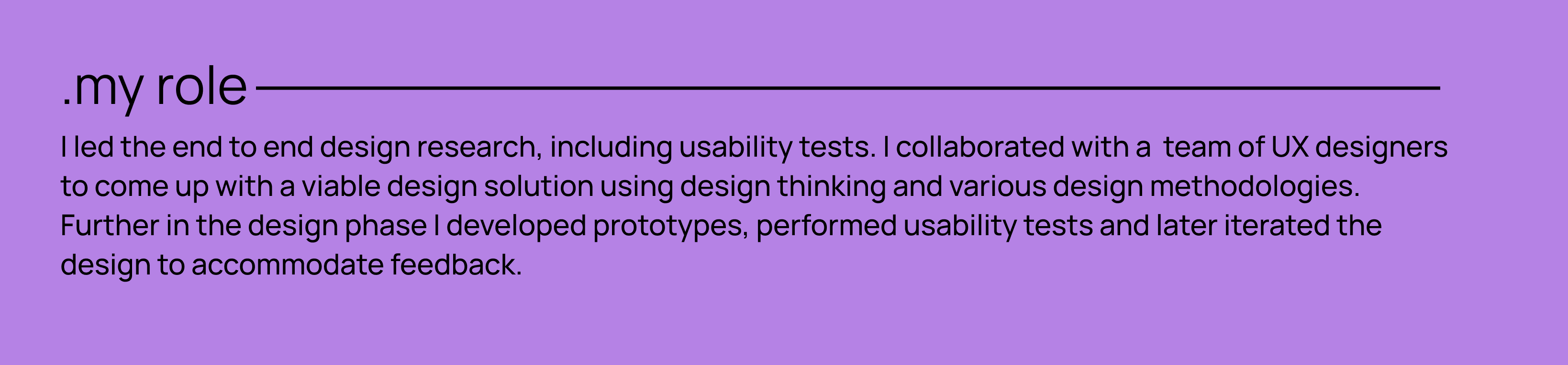

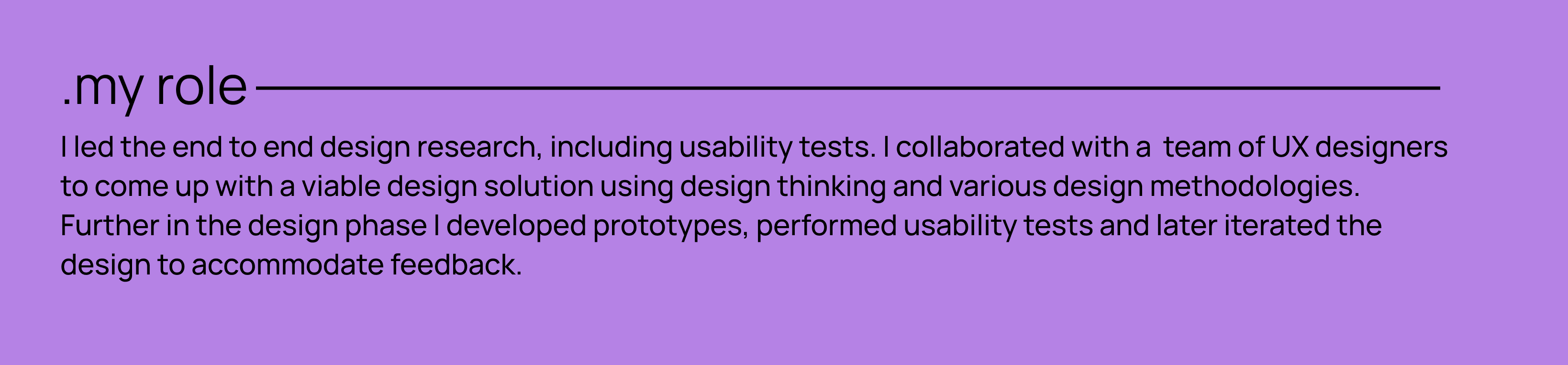

As an immigrant myself, I intimately understood the challenges newcomers face in navigating Canada's financial landscape. Coming from Singapore, where the financial structure is highly advanced and user-friendly, I was driven to create a solution tailored to immigrants in Canada. Through extensive research, I identified and addressed key pain points, informing design decisions that prioritize user needs. From shaping the project's strategy to designing user interactions, my role was centered on empowering newcomers on their financial journey in Canada.

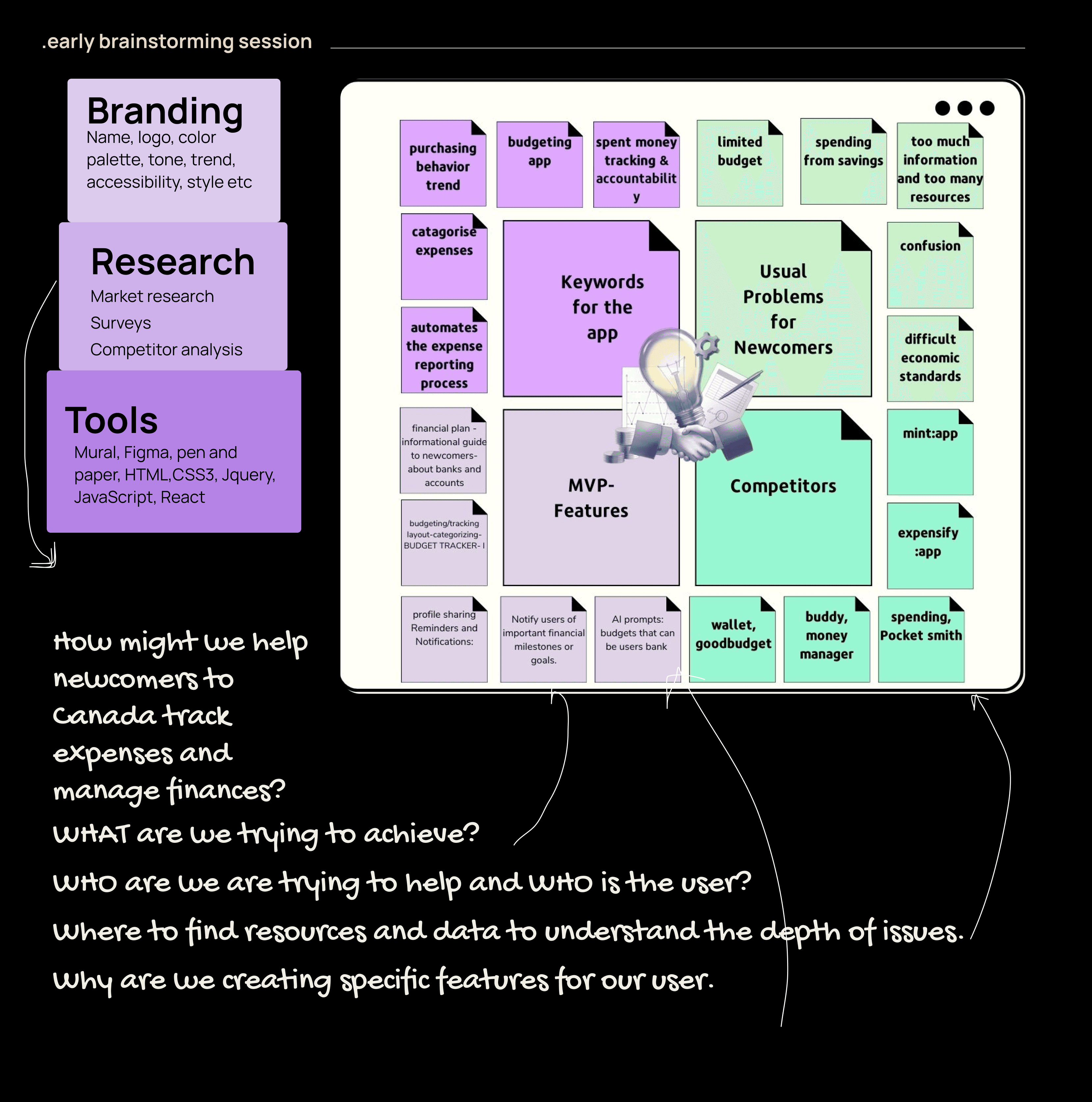

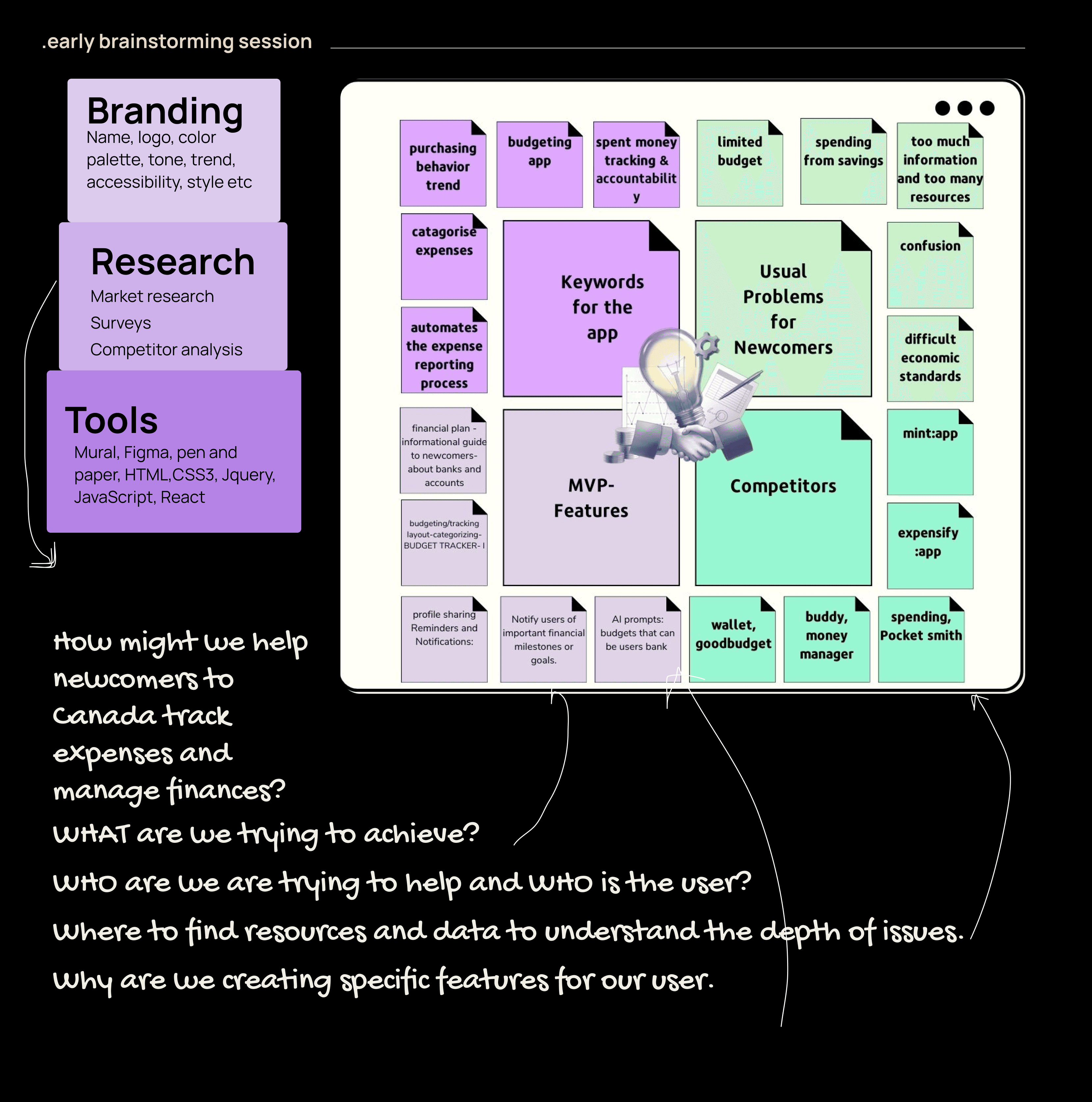

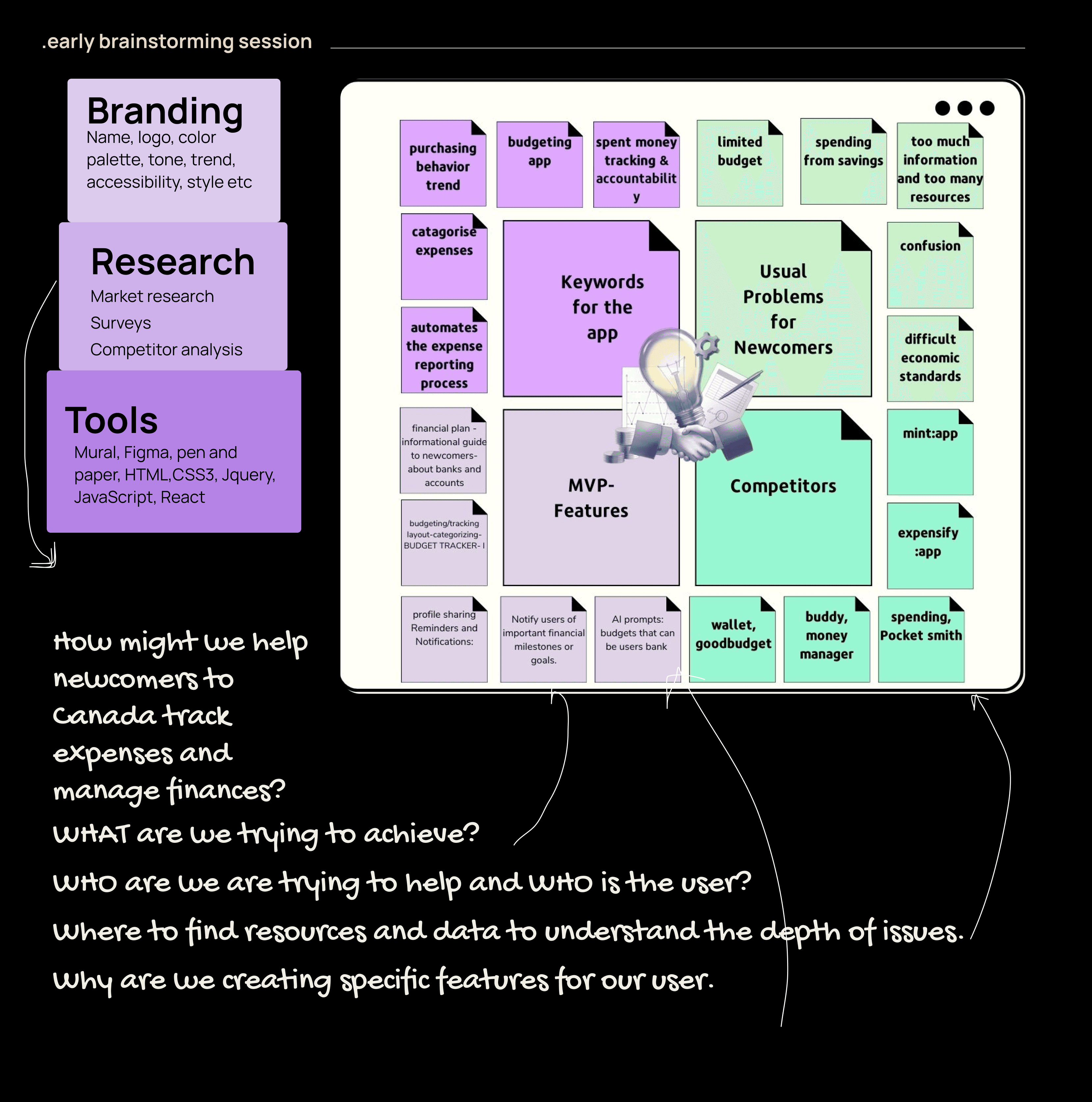

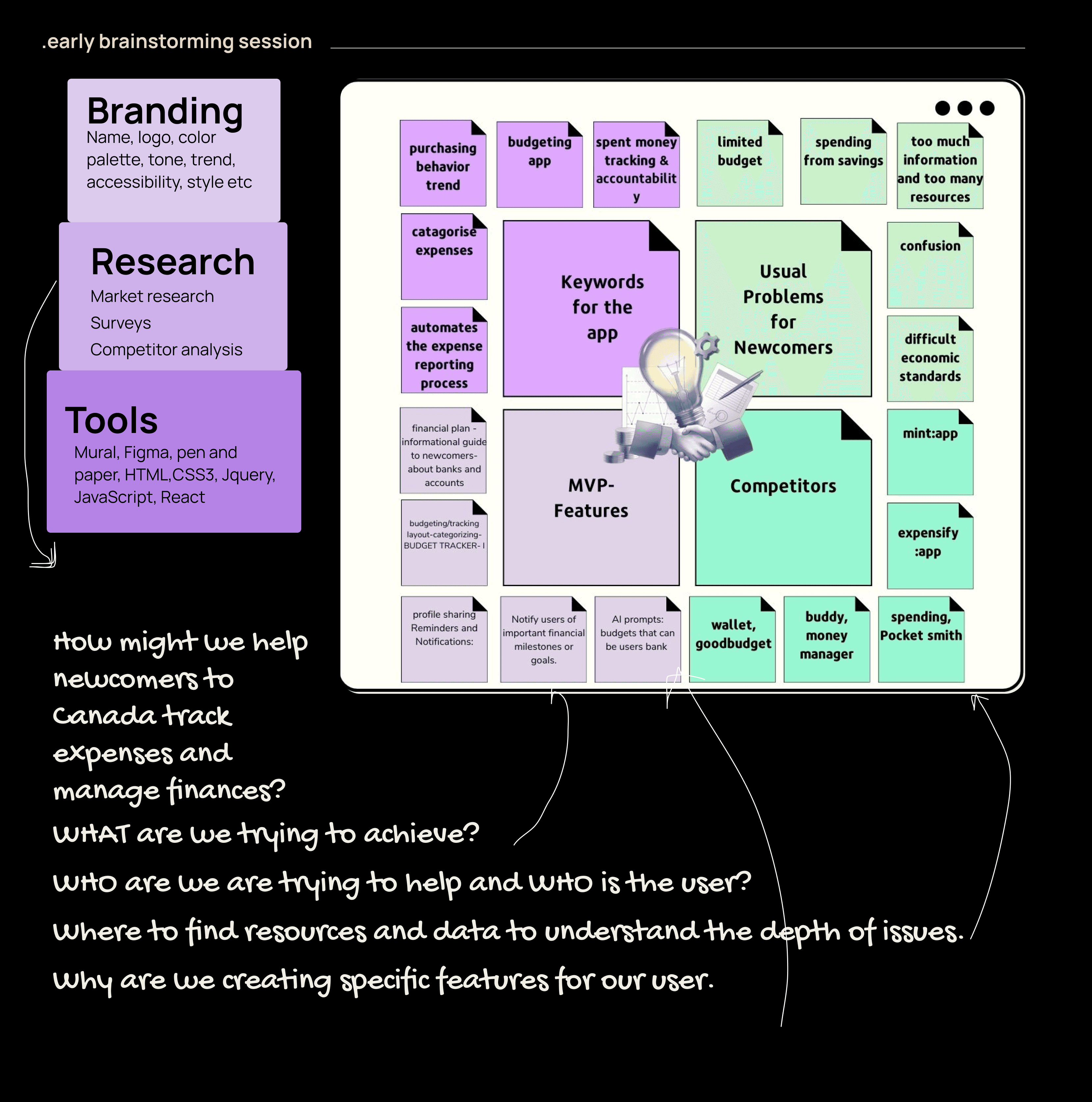

Brainstorming session with the team

Put yourself in the shoes of an immigrant embarking on the journey of settling into a new country, where the initial steps involve navigating the official immigration process and setting up a Canadian bank account. How would you feel if you were offered an app that not only guides you in choosing the right bank but also seamlessly connects it to your finances, allowing you to track your settlement expenditures with your limited savings as you begin a new chapter in your life? This is the exact solution I aimed to provide.

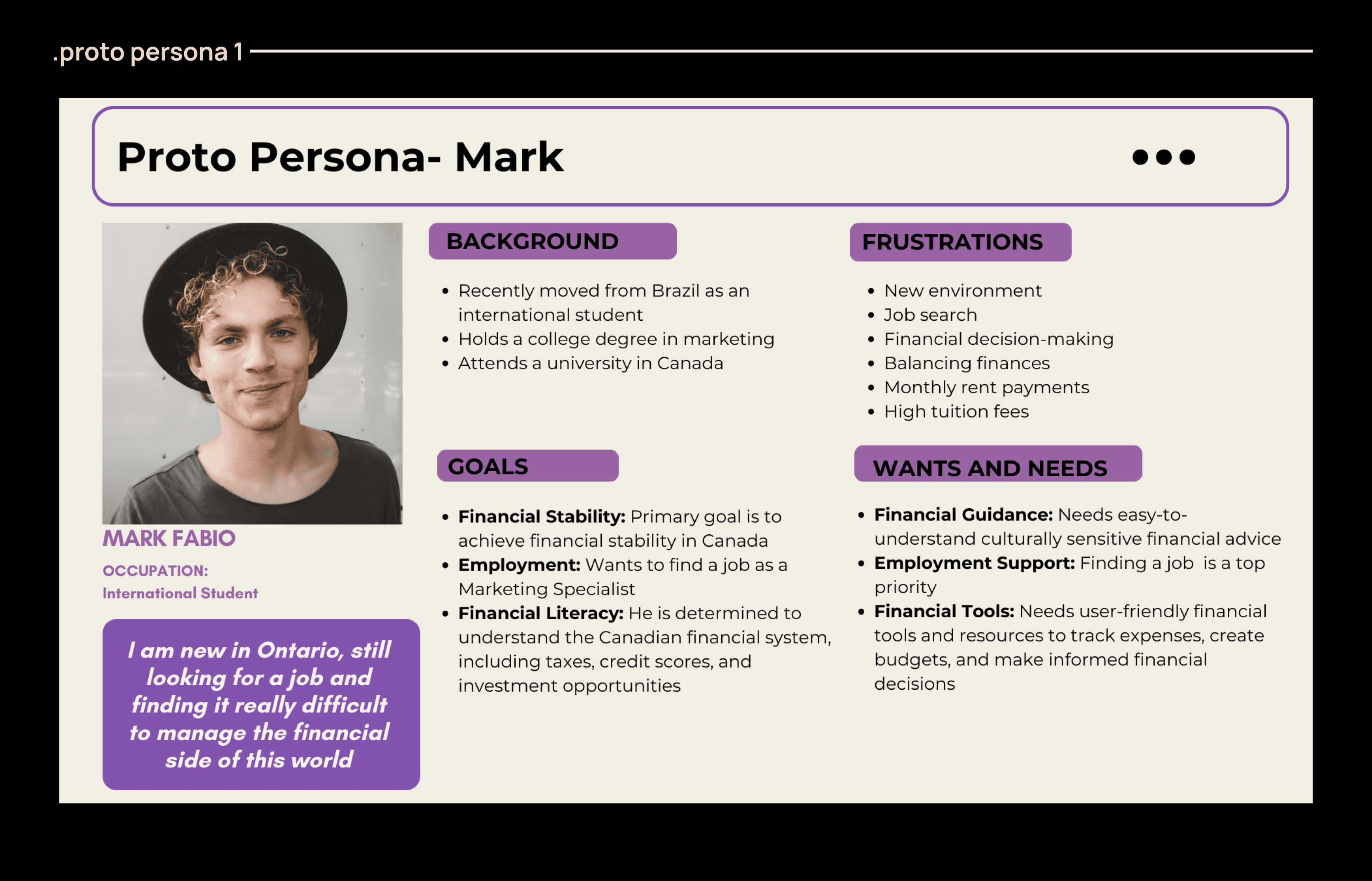

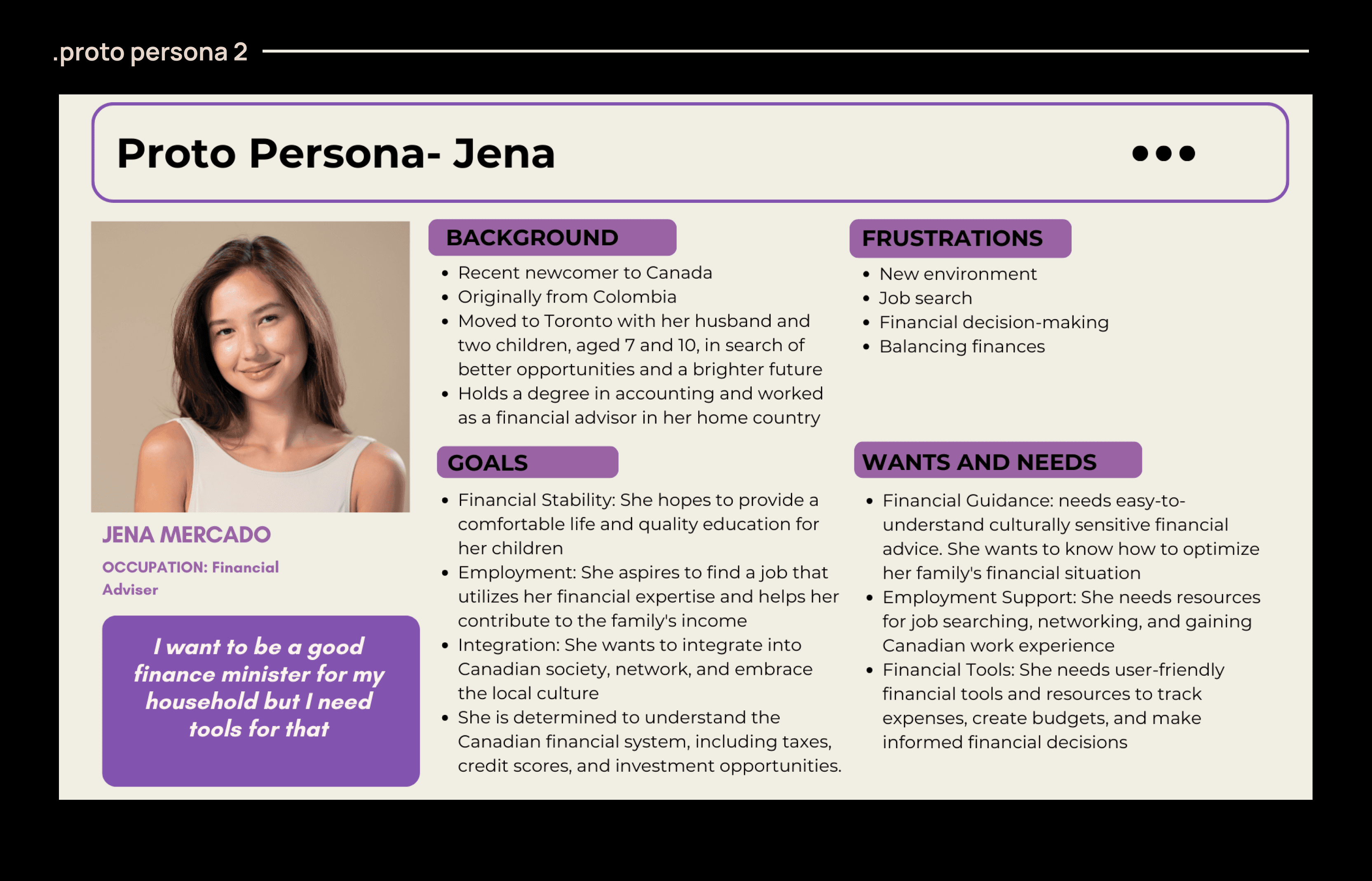

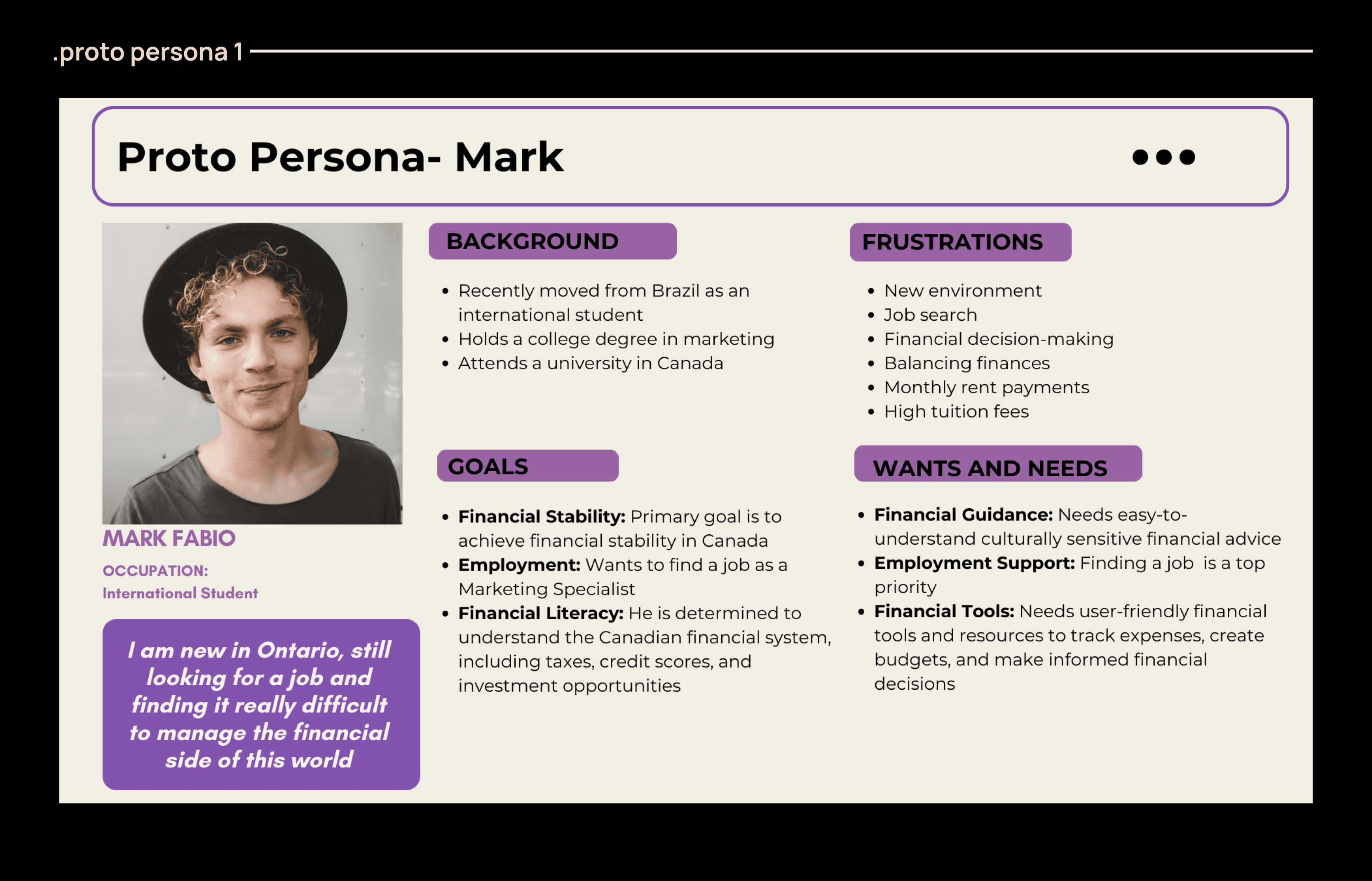

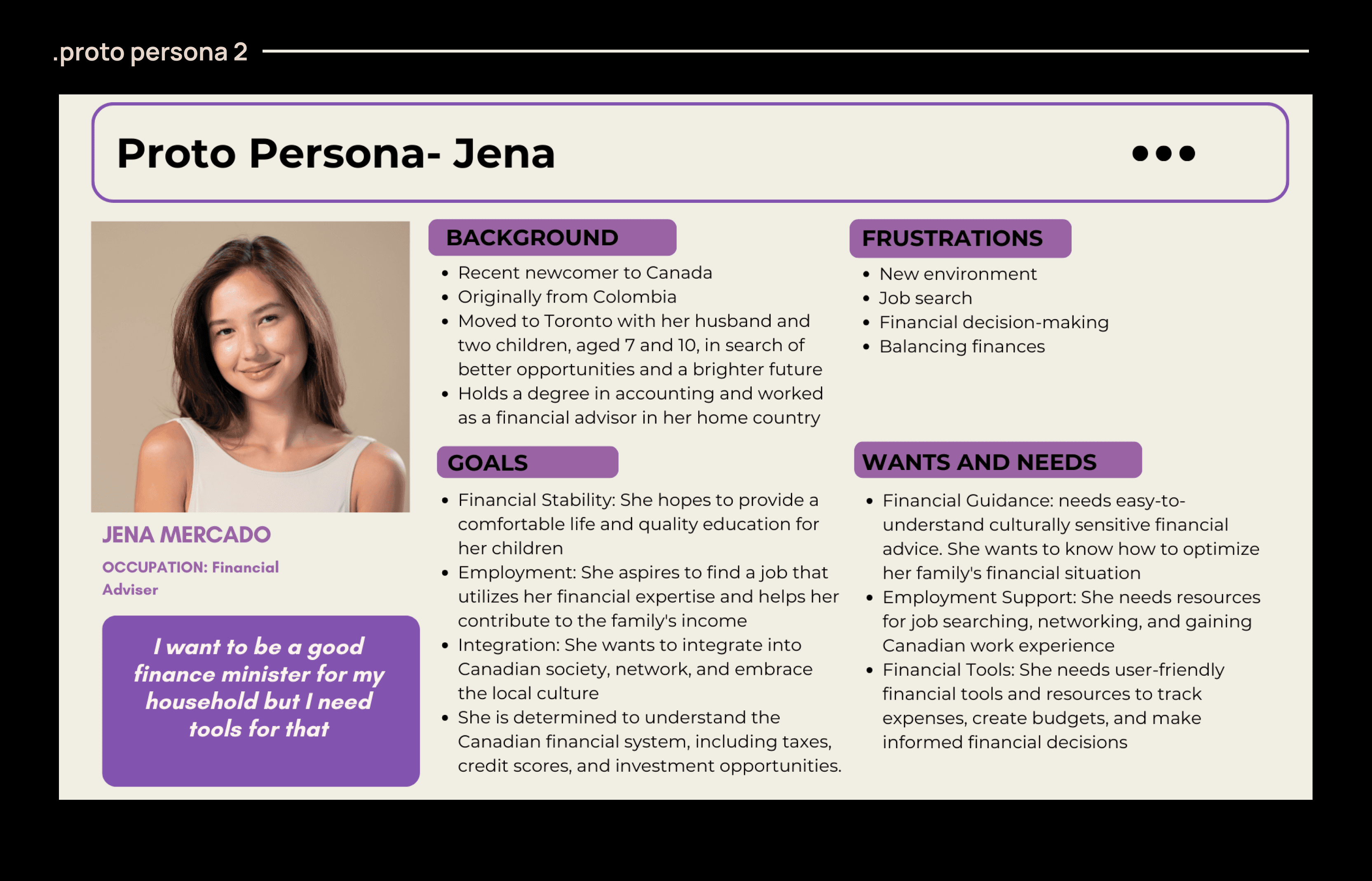

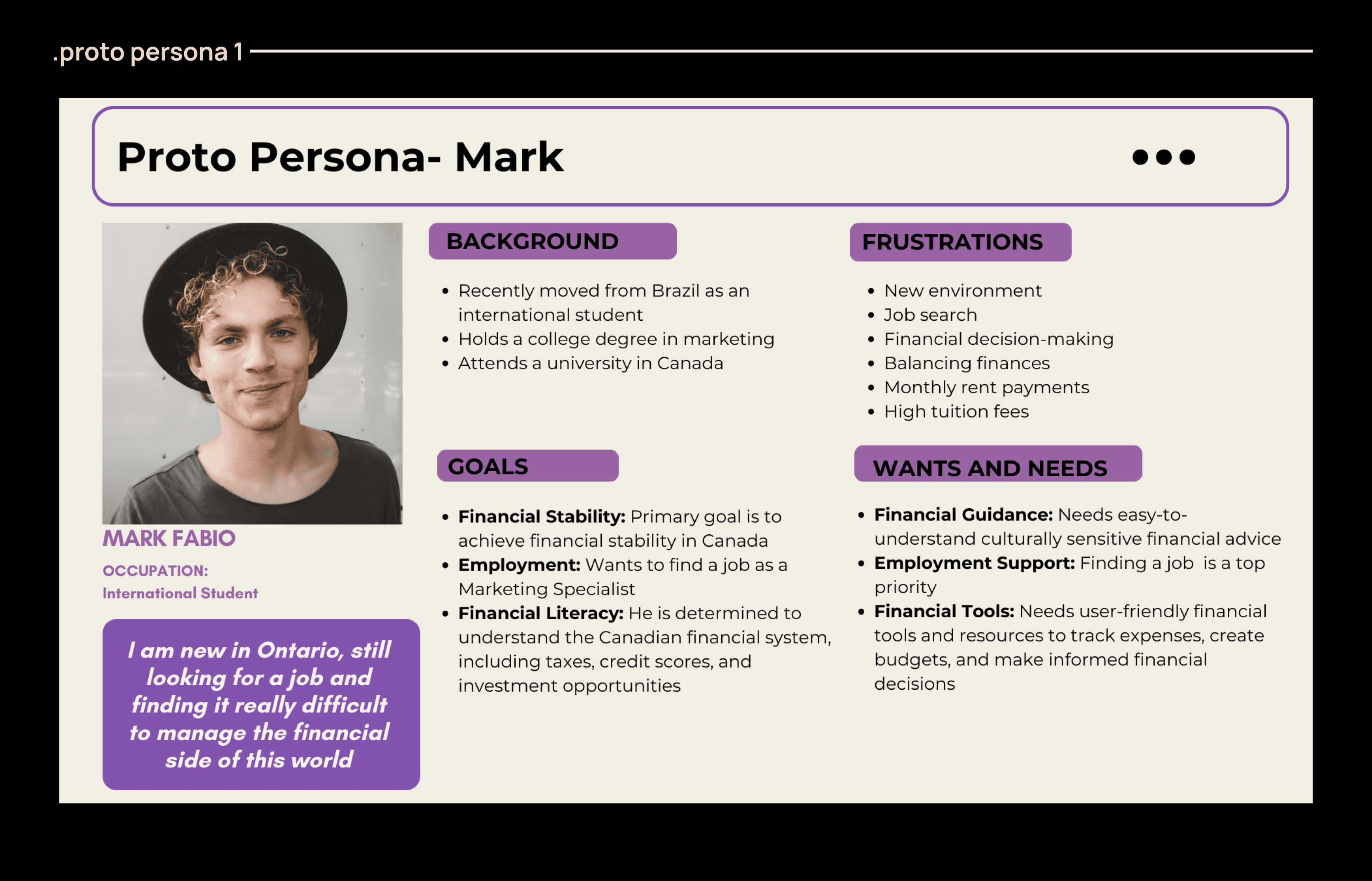

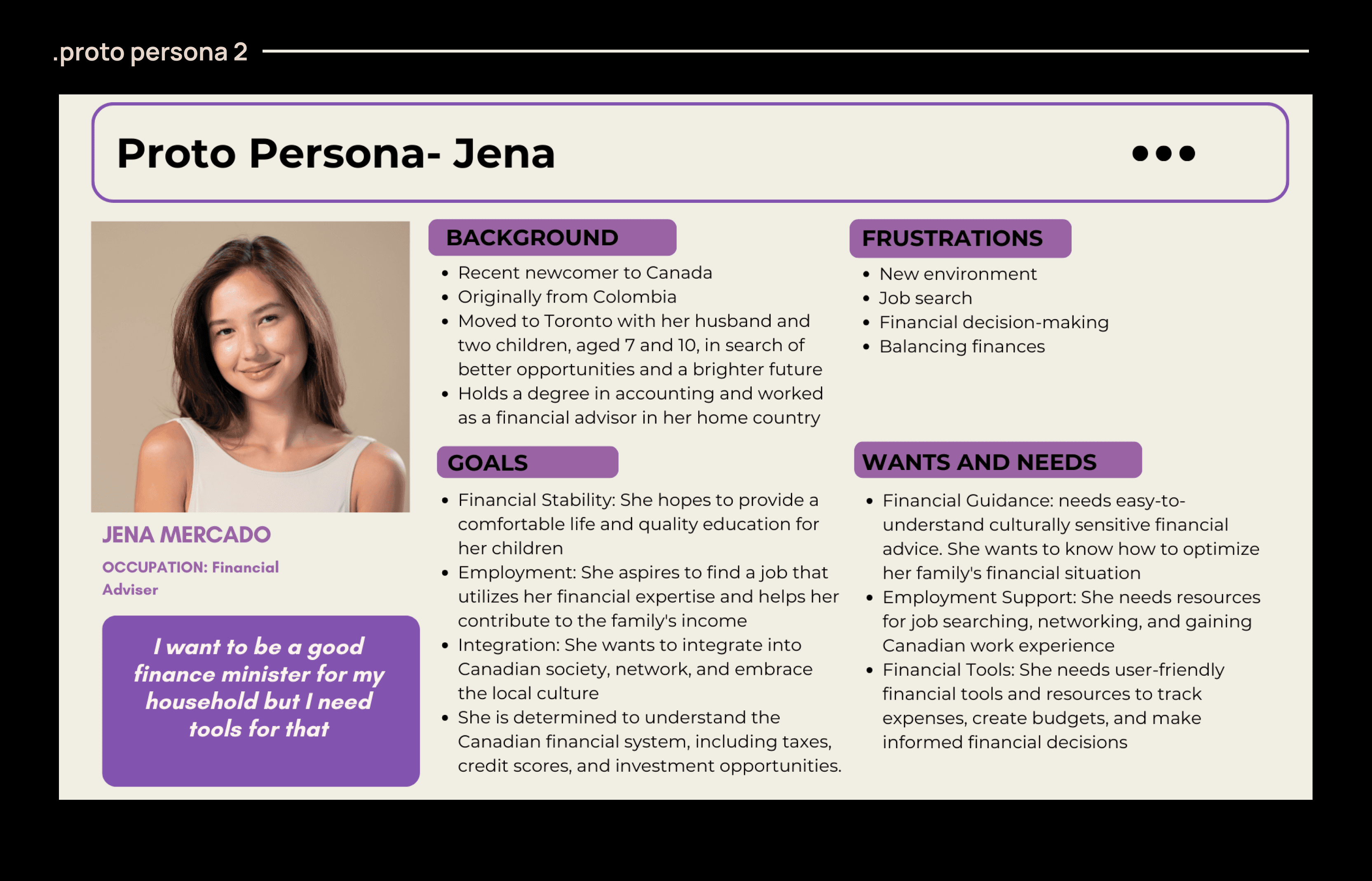

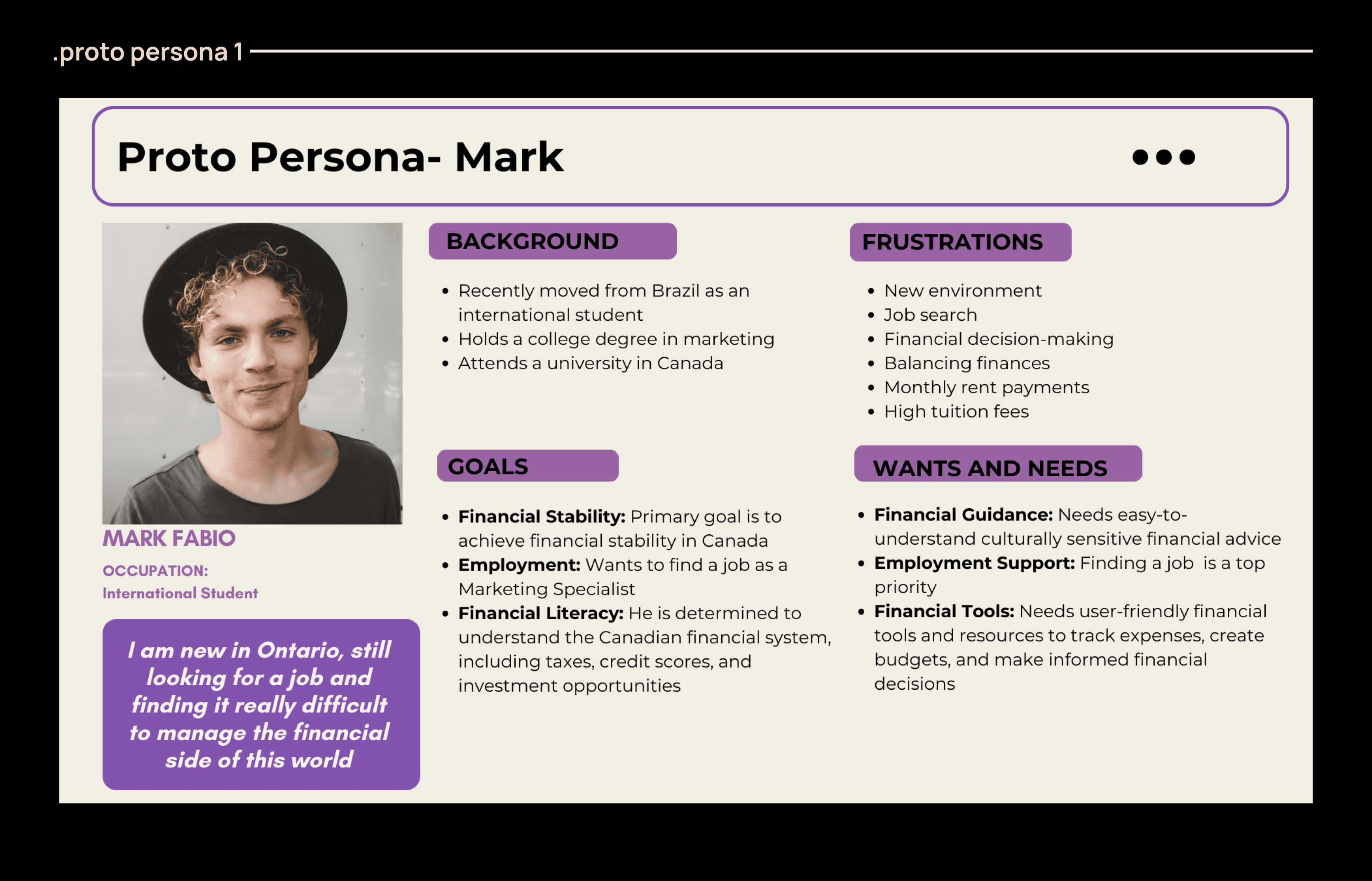

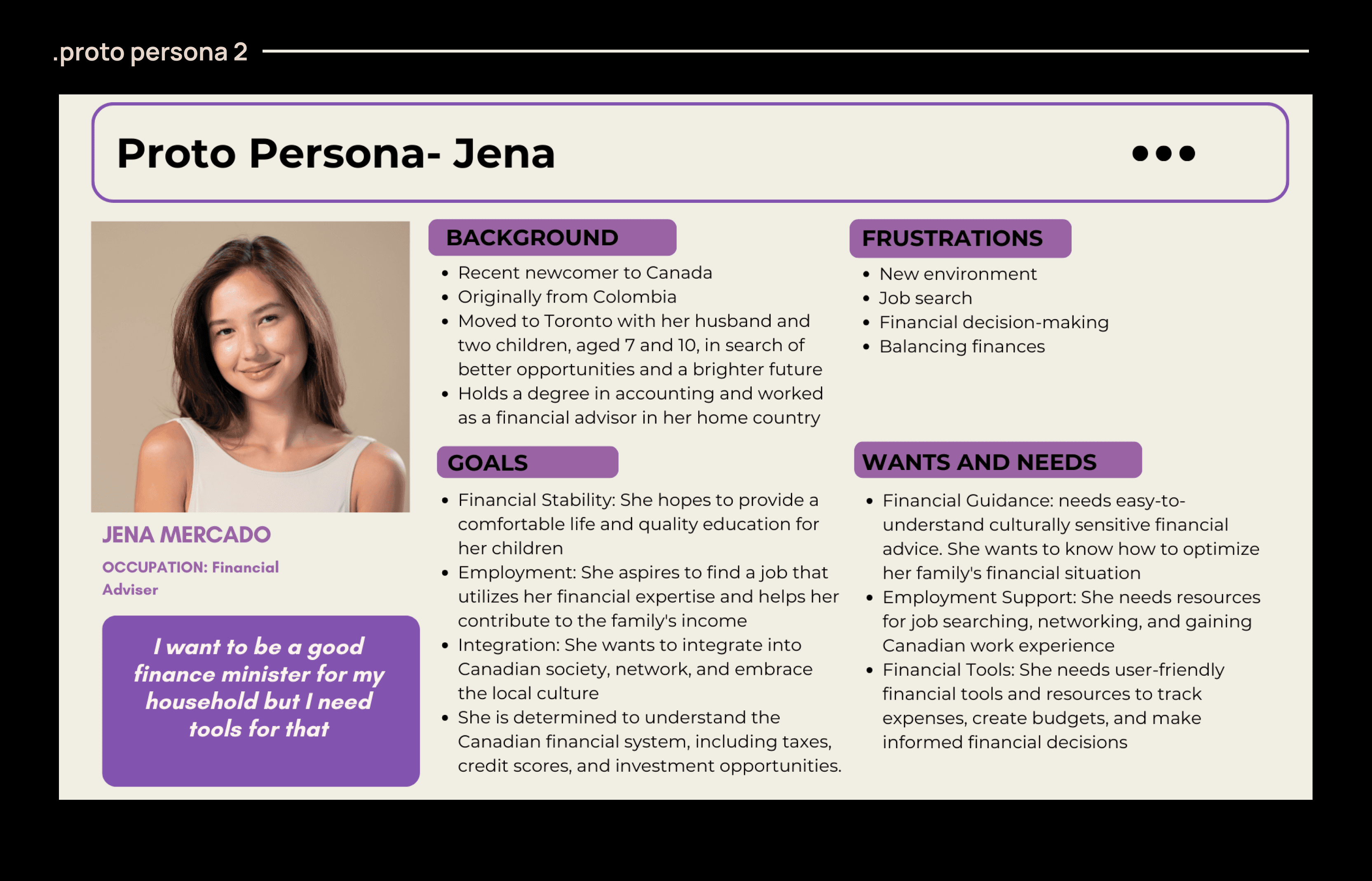

Creating proto-personas of our target users enabled my team to empathize with their needs and facilitated the recruitment of participants for the surveys.

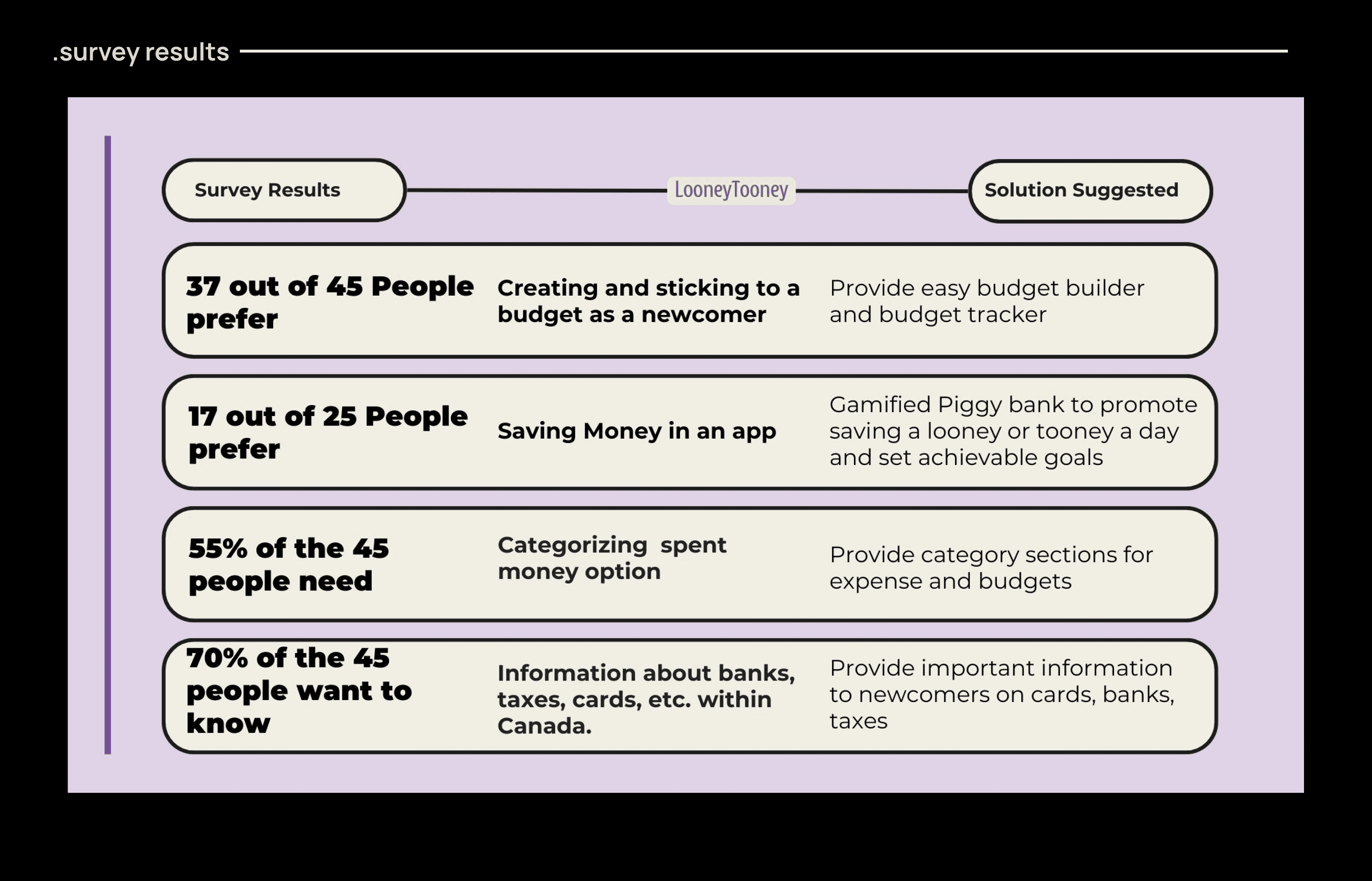

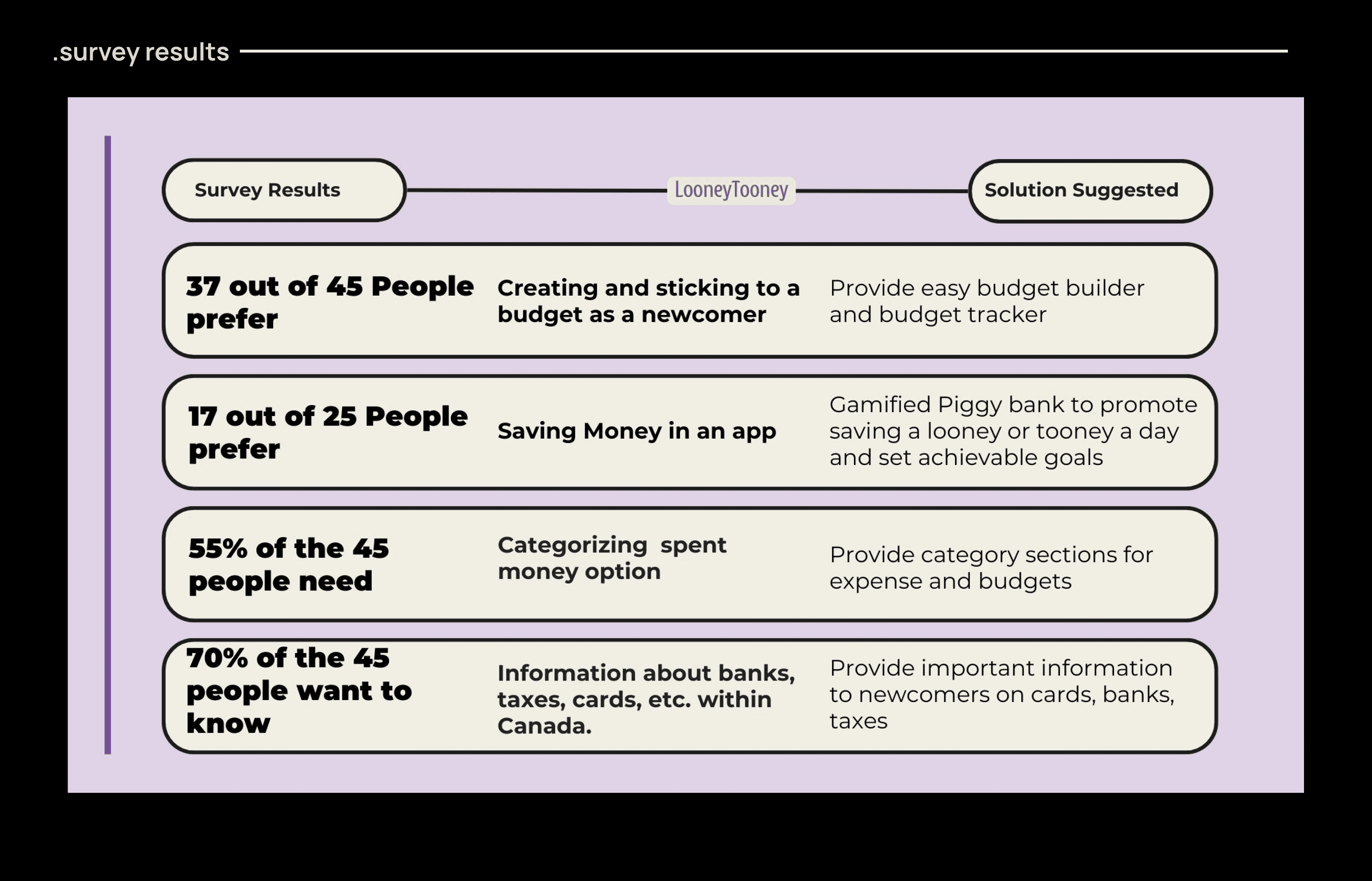

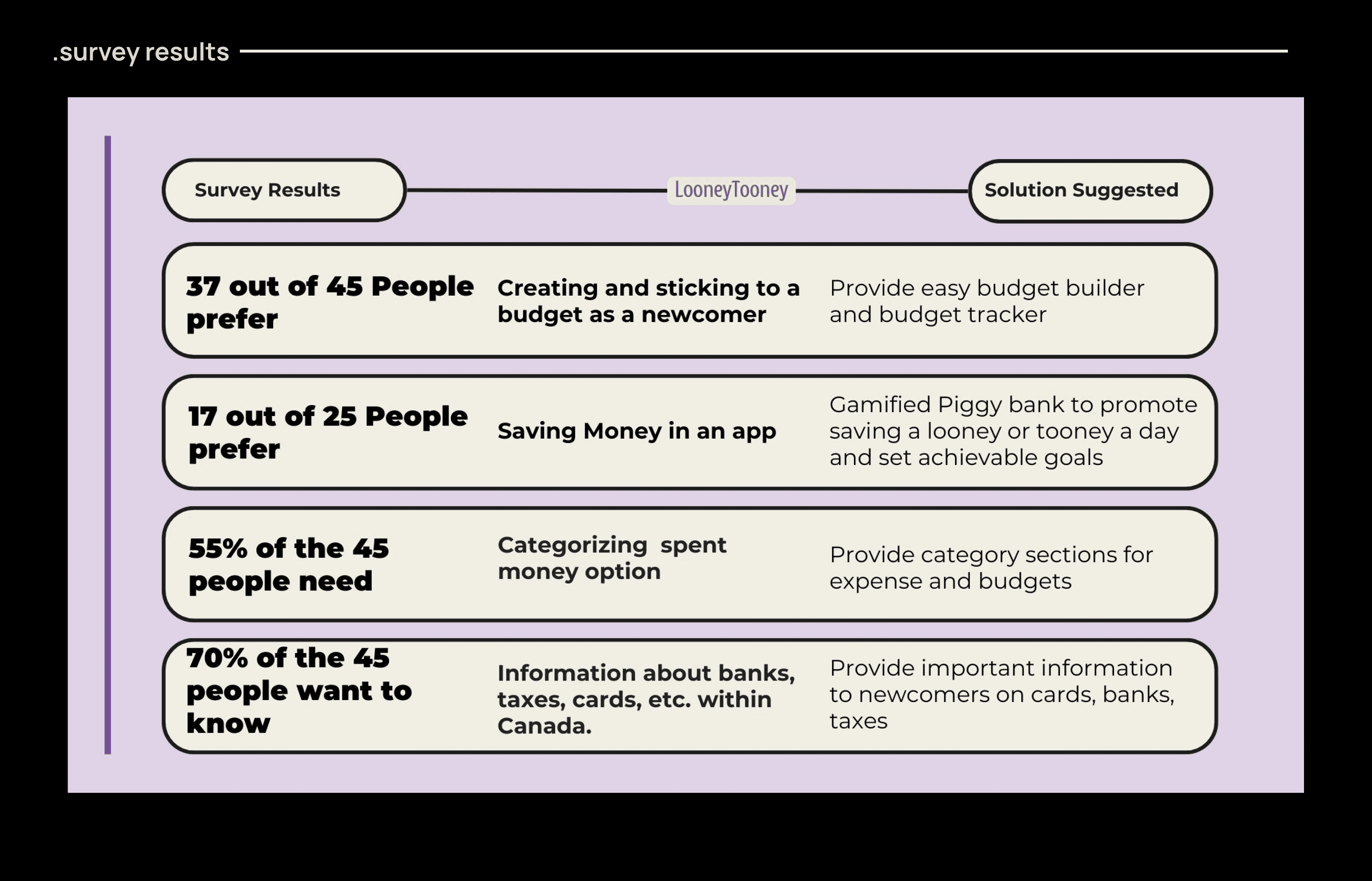

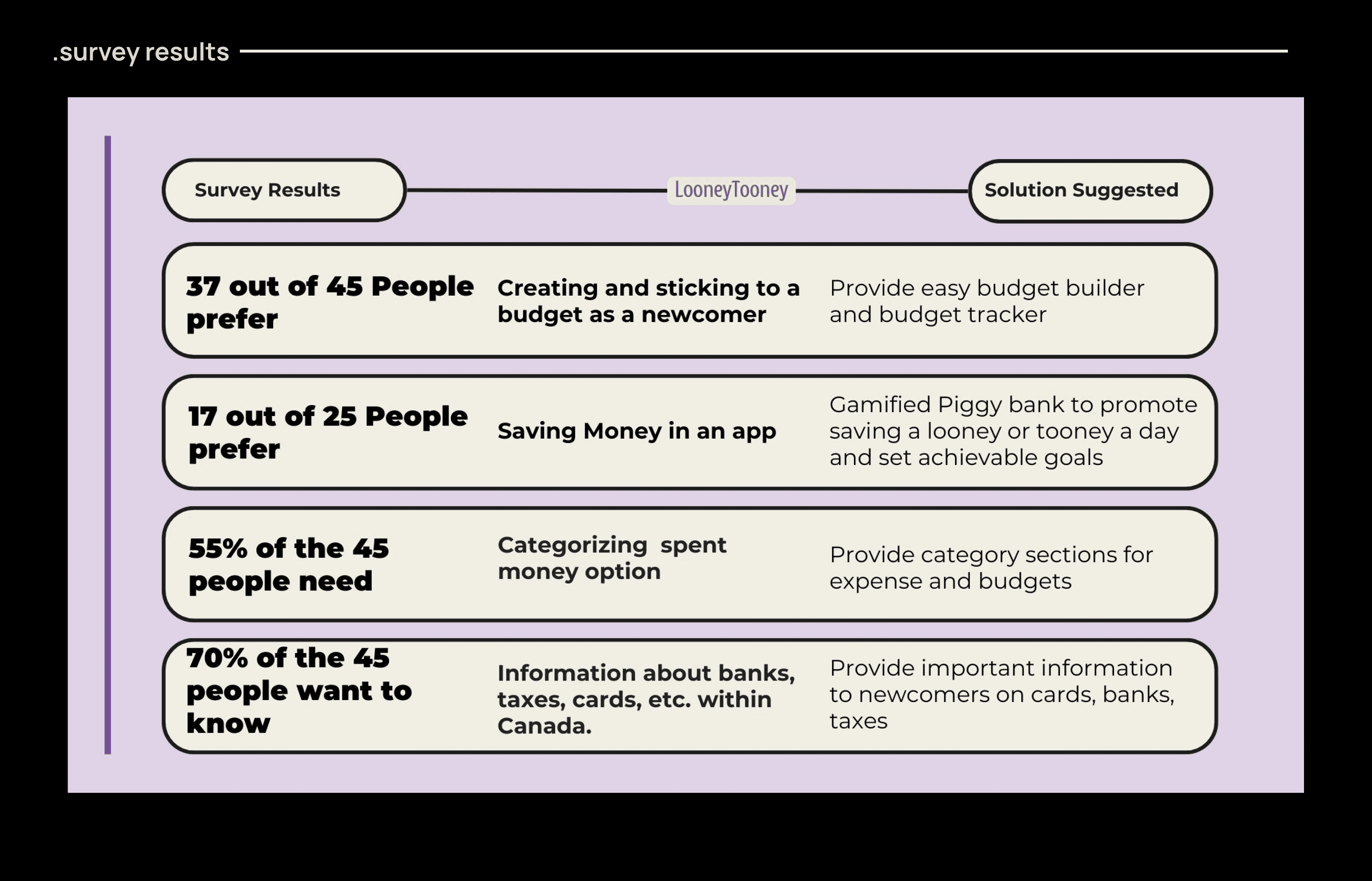

Conducting surveys with recently settled immigrants in Canada, those who had arrived within the past year, was crucial. The insights gathered from these surveys guided us in shaping the direction for potential features.

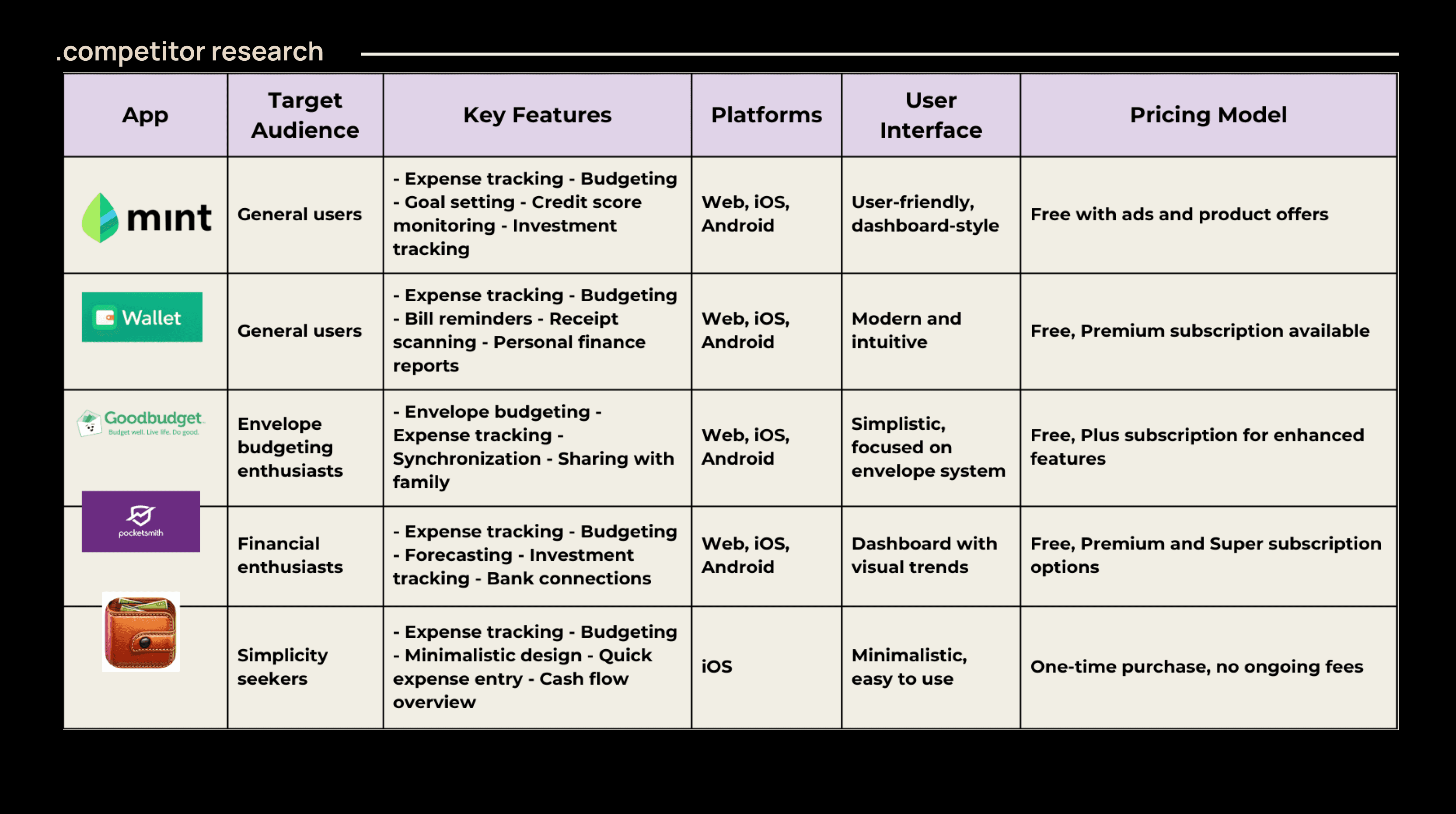

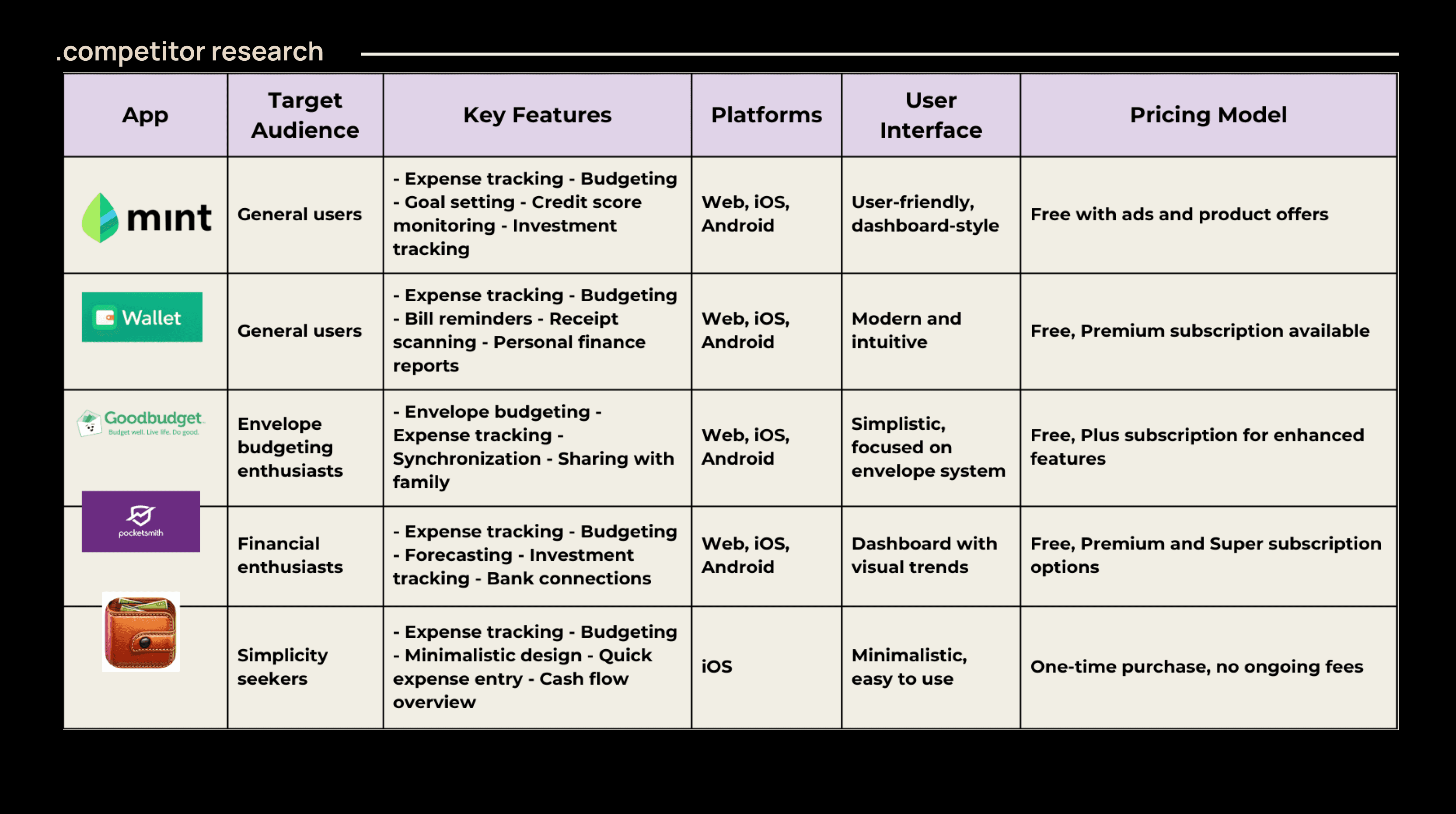

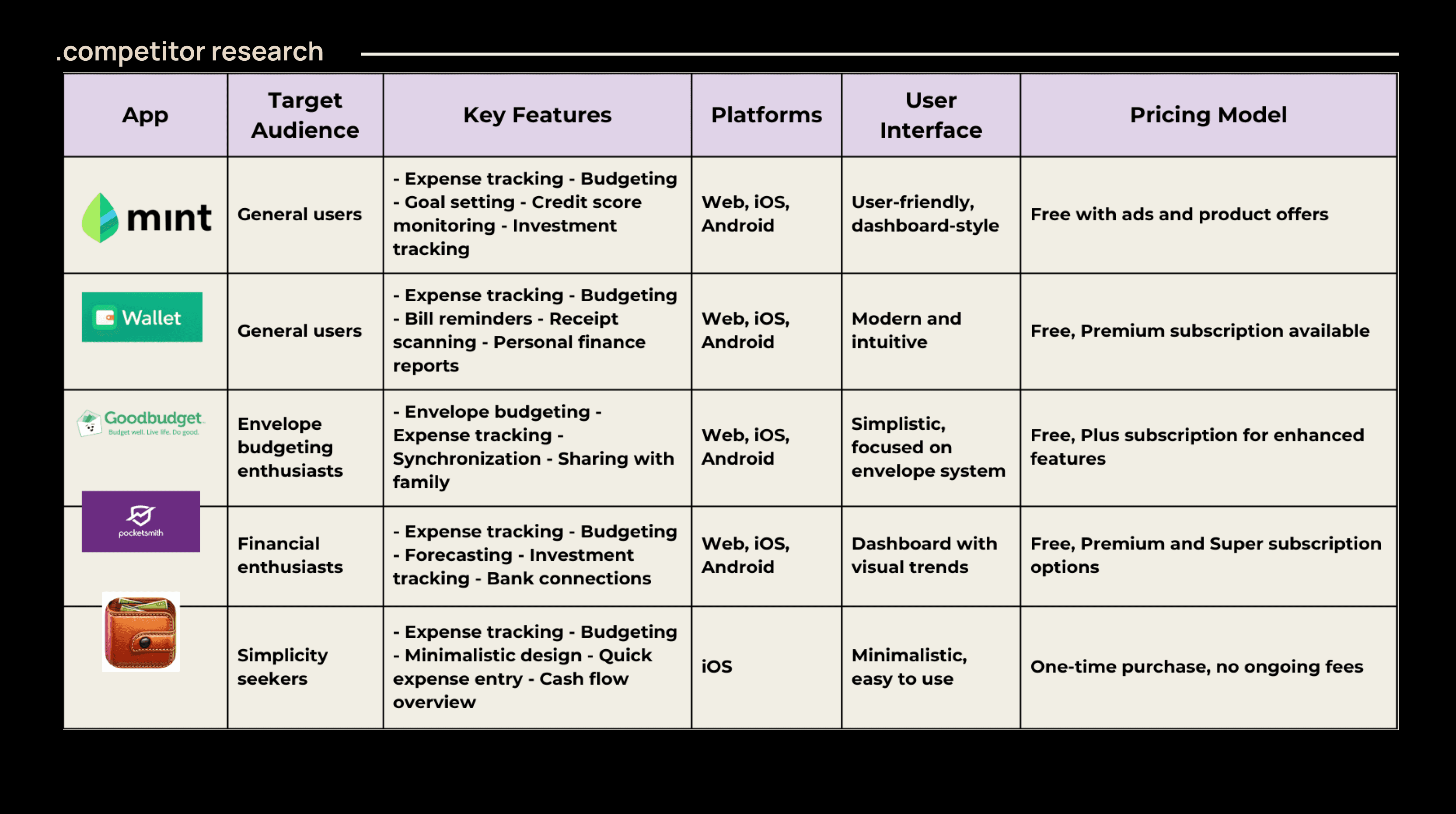

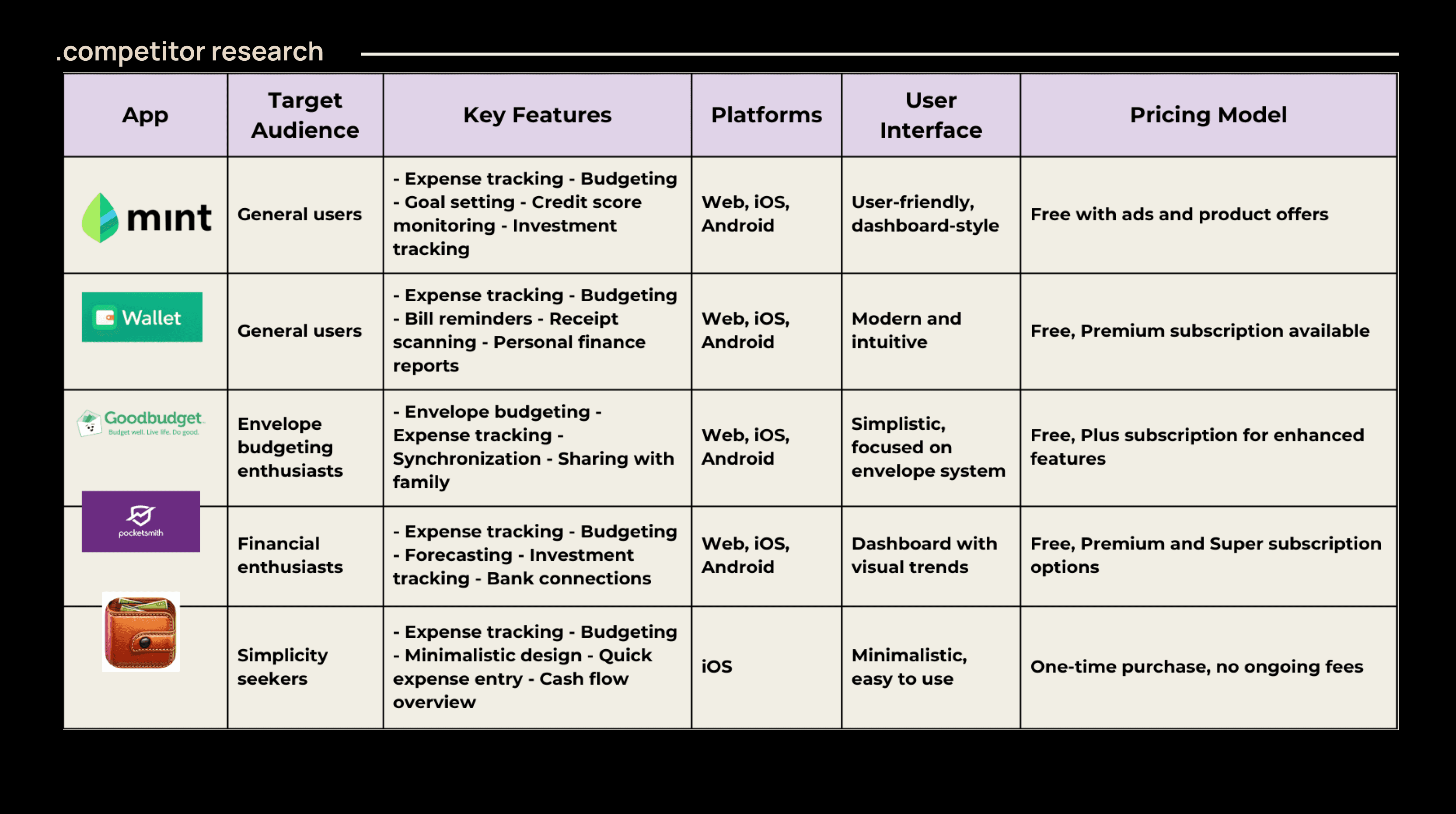

Performing a comprehensive competitor analysis of existing financial tracking, expense management, and budget-building apps being used in Canada allowed me to discern their strengths and weaknesses. By identifying these strengths and weaknesses, I uncovered opportunities to enhance my own product, specifically tailored to assisting immigrants on their financial journey in Canada. Here's a condensed overview of the competitor research:

The most fun part of the project was developing and building an information architecture over which I was going to do sketching and making low-fidelity mockups for possible user pathways.

type

Fintech

timeframe

4 weeks

tools

Figma, Mural

category

UI/UX

An innovative web and mobile application designed to cater to the specific needs of newcomers to Canada. A comprehensive, user-friendly platform that combines information, financial management, and community support to help newcomers transition smoothly into their new lives in Canada.

As an immigrant myself, I intimately understood the challenges newcomers face in navigating Canada's financial landscape. Coming from Singapore, where the financial structure is highly advanced and user-friendly, I was driven to create a solution tailored to immigrants in Canada. Through extensive research, I identified and addressed key pain points, informing design decisions that prioritize user needs. From shaping the project's strategy to designing user interactions, my role was centered on empowering newcomers on their financial journey in Canada.

Brainstorming session with the team

Put yourself in the shoes of an immigrant embarking on the journey of settling into a new country, where the initial steps involve navigating the official immigration process and setting up a Canadian bank account. How would you feel if you were offered an app that not only guides you in choosing the right bank but also seamlessly connects it to your finances, allowing you to track your settlement expenditures with your limited savings as you begin a new chapter in your life? This is the exact solution I aimed to provide.

Creating proto-personas of our target users enabled my team to empathize with their needs and facilitated the recruitment of participants for the surveys.

Conducting surveys with recently settled immigrants in Canada, those who had arrived within the past year, was crucial. The insights gathered from these surveys guided us in shaping the direction for potential features.

Performing a comprehensive competitor analysis of existing financial tracking, expense management, and budget-building apps being used in Canada allowed me to discern their strengths and weaknesses. By identifying these strengths and weaknesses, I uncovered opportunities to enhance my own product, specifically tailored to assisting immigrants on their financial journey in Canada. Here's a condensed overview of the competitor research:

The most fun part of the project was developing and building an information architecture over which I was going to do sketching and making low-fidelity mockups for possible user pathways.

type

Fintech

timeframe

4 weeks

tools

Figma, Mural

category

UI/UX

An innovative web and mobile application designed to cater to the specific needs of newcomers to Canada. A comprehensive, user-friendly platform that combines information, financial management, and community support to help newcomers transition smoothly into their new lives in Canada.

As an immigrant myself, I intimately understood the challenges newcomers face in navigating Canada's financial landscape. Coming from Singapore, where the financial structure is highly advanced and user-friendly, I was driven to create a solution tailored to immigrants in Canada. Through extensive research, I identified and addressed key pain points, informing design decisions that prioritize user needs. From shaping the project's strategy to designing user interactions, my role was centered on empowering newcomers on their financial journey in Canada.

Brainstorming session with the team

Put yourself in the shoes of an immigrant embarking on the journey of settling into a new country, where the initial steps involve navigating the official immigration process and setting up a Canadian bank account. How would you feel if you were offered an app that not only guides you in choosing the right bank but also seamlessly connects it to your finances, allowing you to track your settlement expenditures with your limited savings as you begin a new chapter in your life? This is the exact solution I aimed to provide.

Creating proto-personas of our target users enabled my team to empathize with their needs and facilitated the recruitment of participants for the surveys.

Conducting surveys with recently settled immigrants in Canada, those who had arrived within the past year, was crucial. The insights gathered from these surveys guided us in shaping the direction for potential features.

Performing a comprehensive competitor analysis of existing financial tracking, expense management, and budget-building apps being used in Canada allowed me to discern their strengths and weaknesses. By identifying these strengths and weaknesses, I uncovered opportunities to enhance my own product, specifically tailored to assisting immigrants on their financial journey in Canada. Here's a condensed overview of the competitor research:

The most fun part of the project was developing and building an information architecture over which I was going to do sketching and making low-fidelity mockups for possible user pathways.

type

Fintech

timeframe

4 weeks

tools

Figma, Mural

category

UI/UX

An innovative web and mobile application designed to cater to the specific needs of newcomers to Canada. A comprehensive, user-friendly platform that combines information, financial management, and community support to help newcomers transition smoothly into their new lives in Canada.

As an immigrant myself, I intimately understood the challenges newcomers face in navigating Canada's financial landscape. Coming from Singapore, where the financial structure is highly advanced and user-friendly, I was driven to create a solution tailored to immigrants in Canada. Through extensive research, I identified and addressed key pain points, informing design decisions that prioritize user needs. From shaping the project's strategy to designing user interactions, my role was centered on empowering newcomers on their financial journey in Canada.

Brainstorming session with the team

Put yourself in the shoes of an immigrant embarking on the journey of settling into a new country, where the initial steps involve navigating the official immigration process and setting up a Canadian bank account. How would you feel if you were offered an app that not only guides you in choosing the right bank but also seamlessly connects it to your finances, allowing you to track your settlement expenditures with your limited savings as you begin a new chapter in your life? This is the exact solution I aimed to provide.

Creating proto-personas of our target users enabled my team to empathize with their needs and facilitated the recruitment of participants for the surveys.

Conducting surveys with recently settled immigrants in Canada, those who had arrived within the past year, was crucial. The insights gathered from these surveys guided us in shaping the direction for potential features.

Performing a comprehensive competitor analysis of existing financial tracking, expense management, and budget-building apps being used in Canada allowed me to discern their strengths and weaknesses. By identifying these strengths and weaknesses, I uncovered opportunities to enhance my own product, specifically tailored to assisting immigrants on their financial journey in Canada. Here's a condensed overview of the competitor research:

The most fun part of the project was developing and building an information architecture over which I was going to do sketching and making low-fidelity mockups for possible user pathways.

type

Fintech

timeframe

4 weeks

tools

Figma, Mural

category

UI/UX

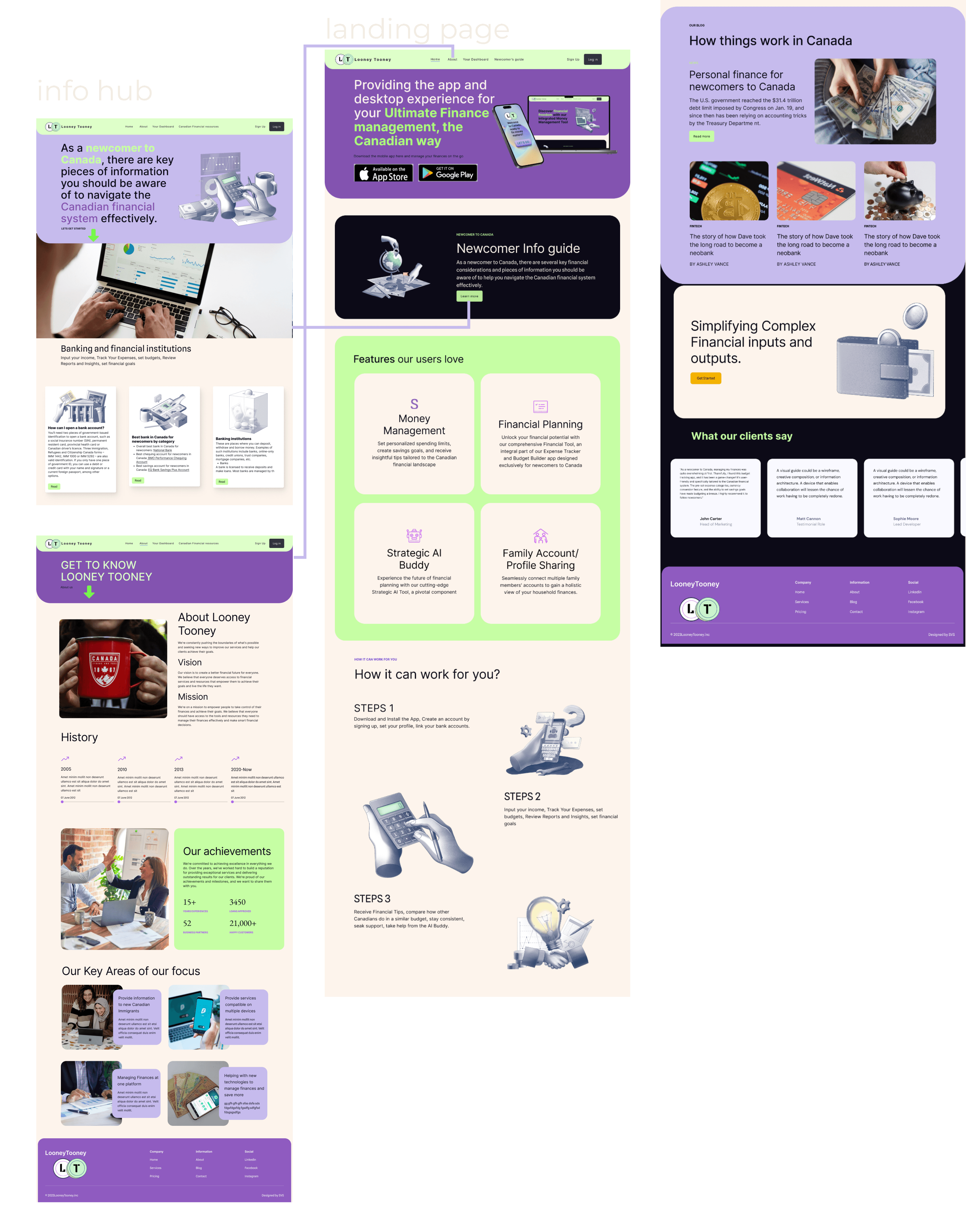

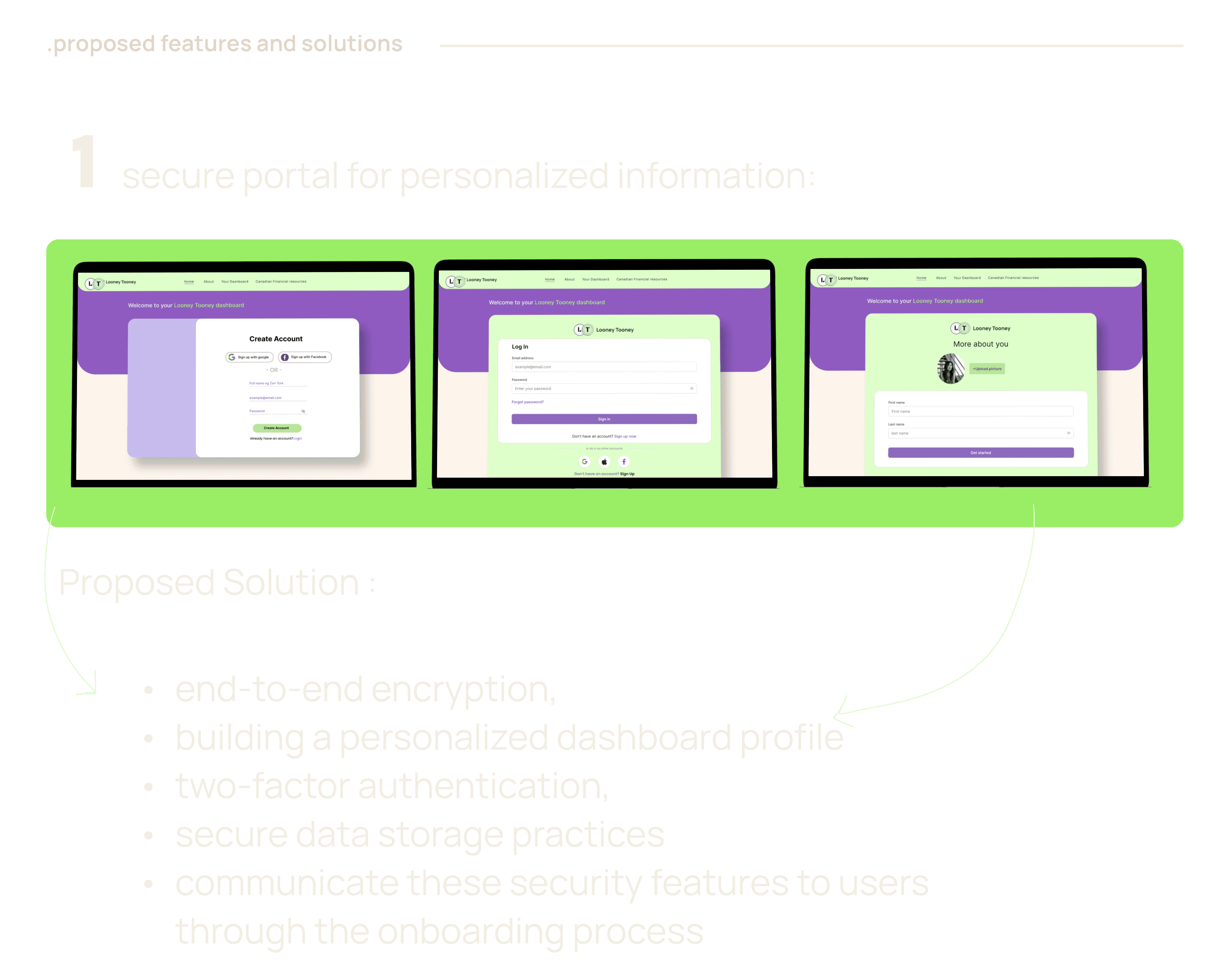

.putting the pieces together proposing solutions

.putting the pieces together proposing solutions

.putting the pieces together proposing solutions

.putting the pieces together proposing solutions

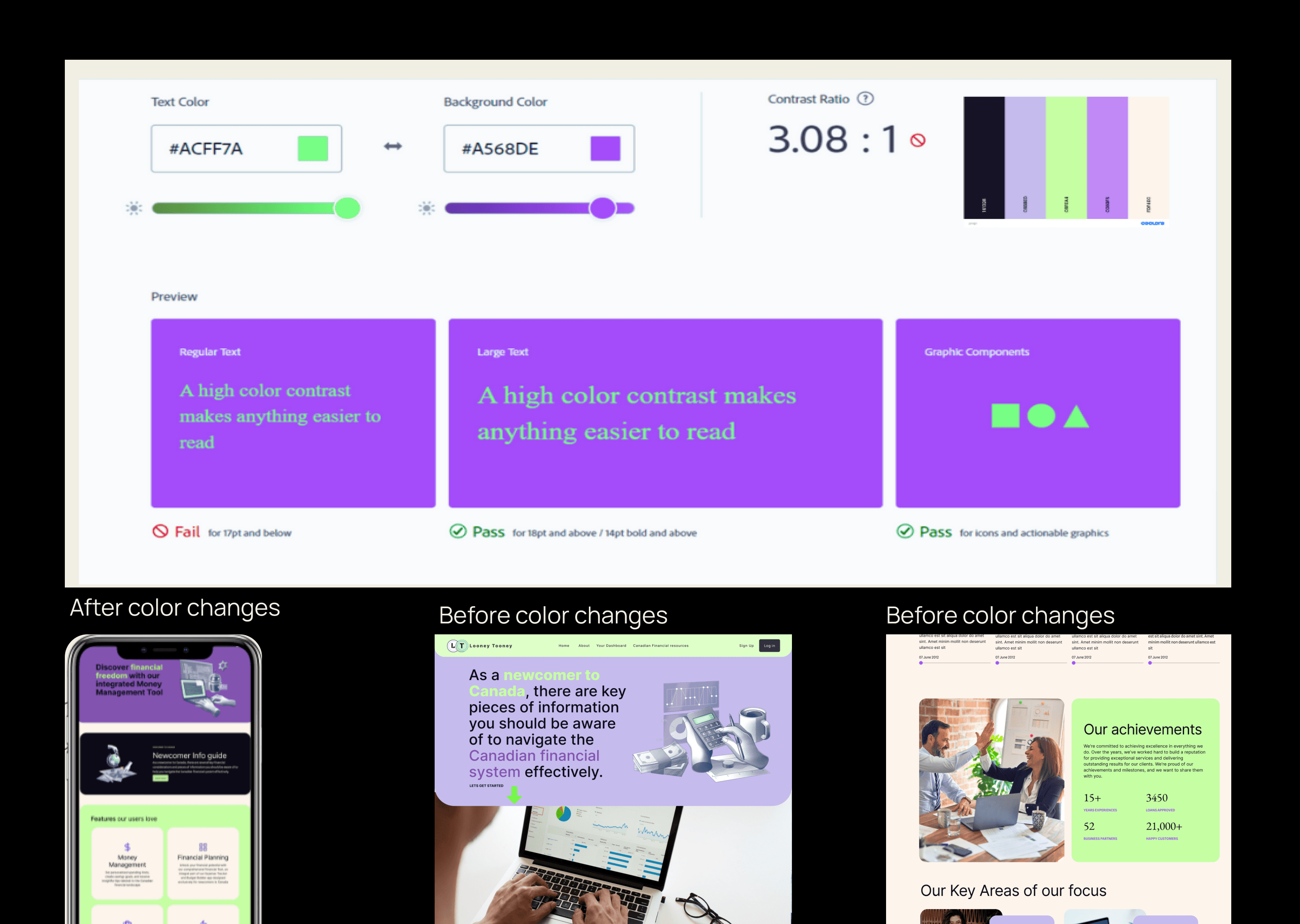

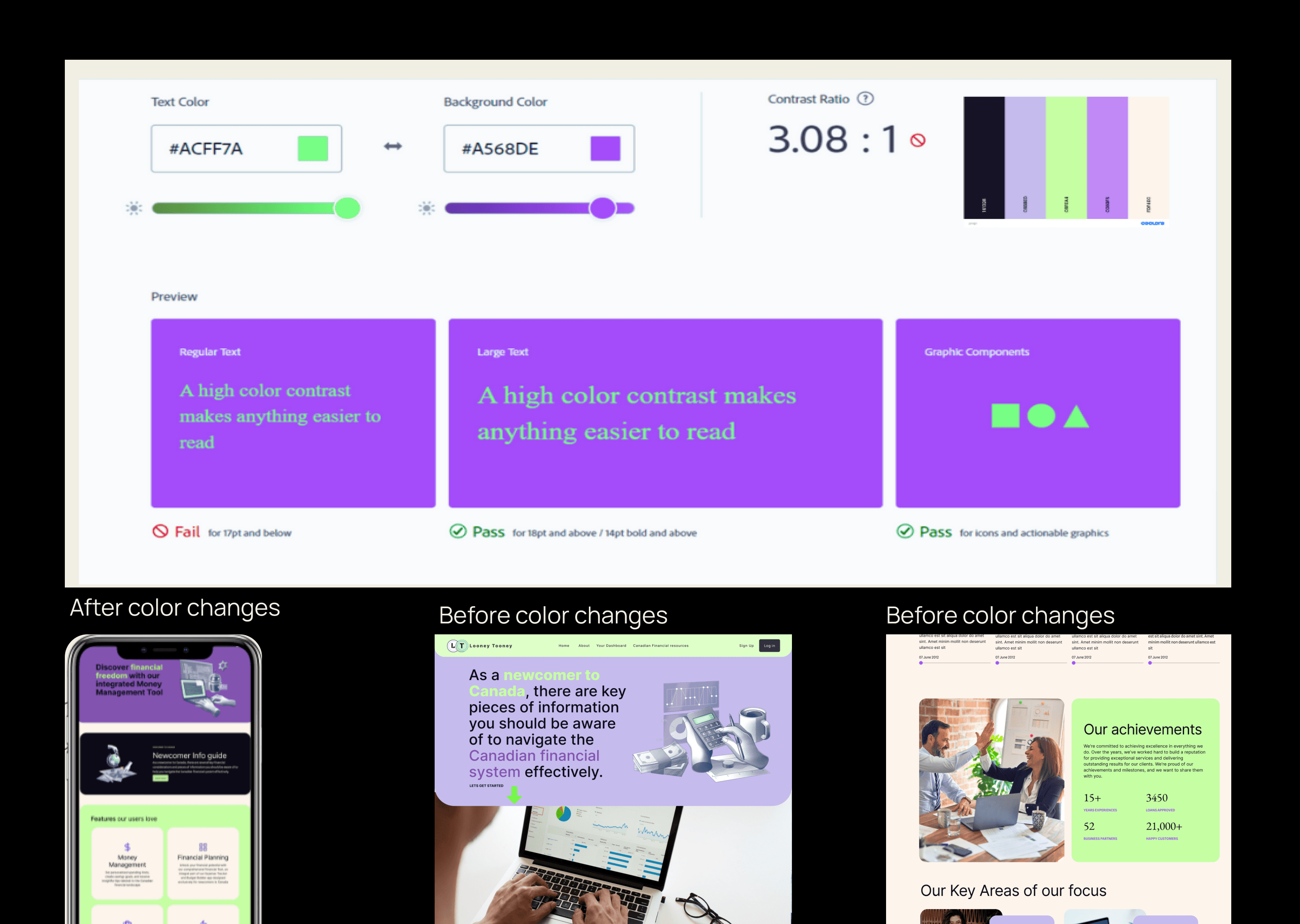

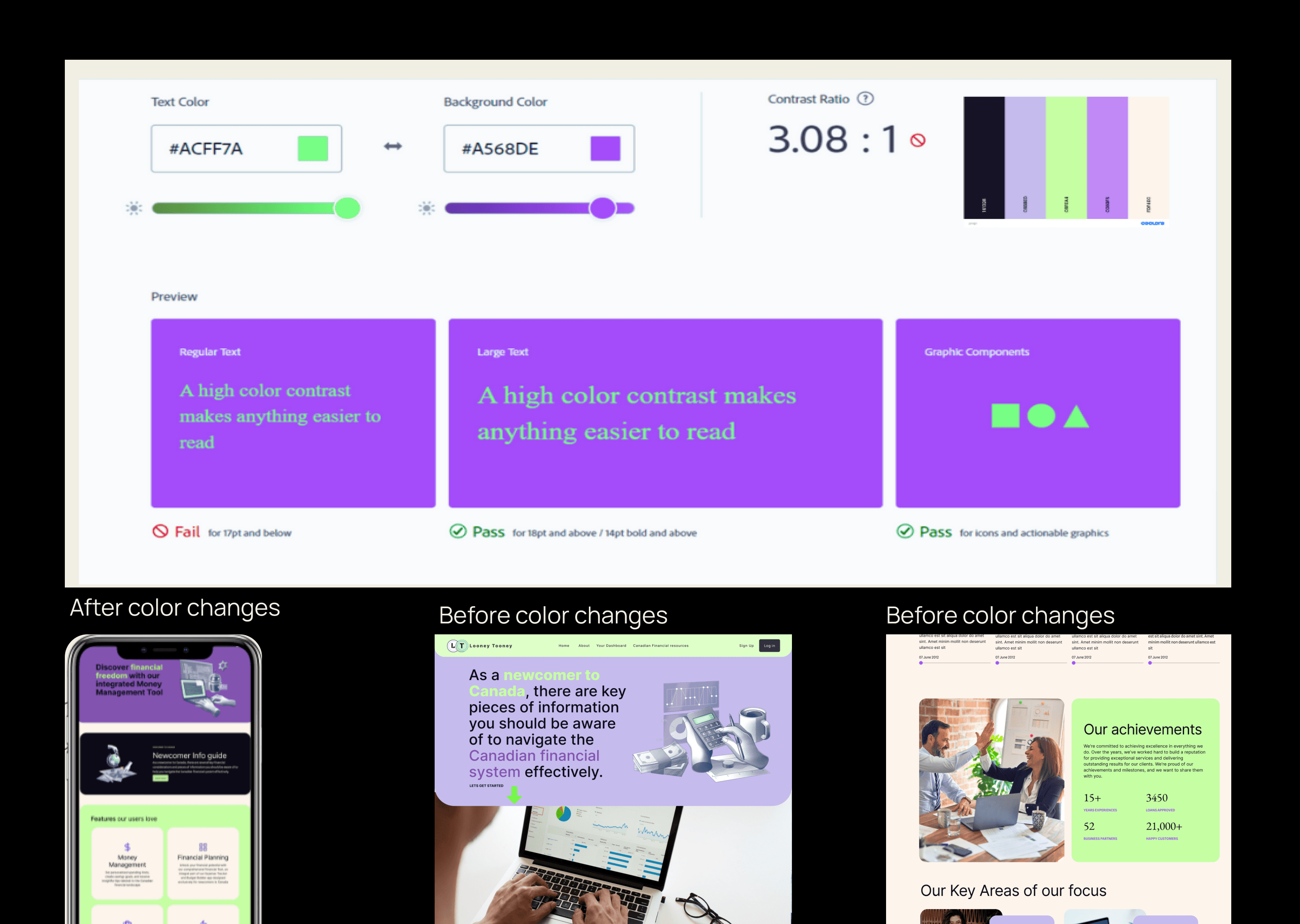

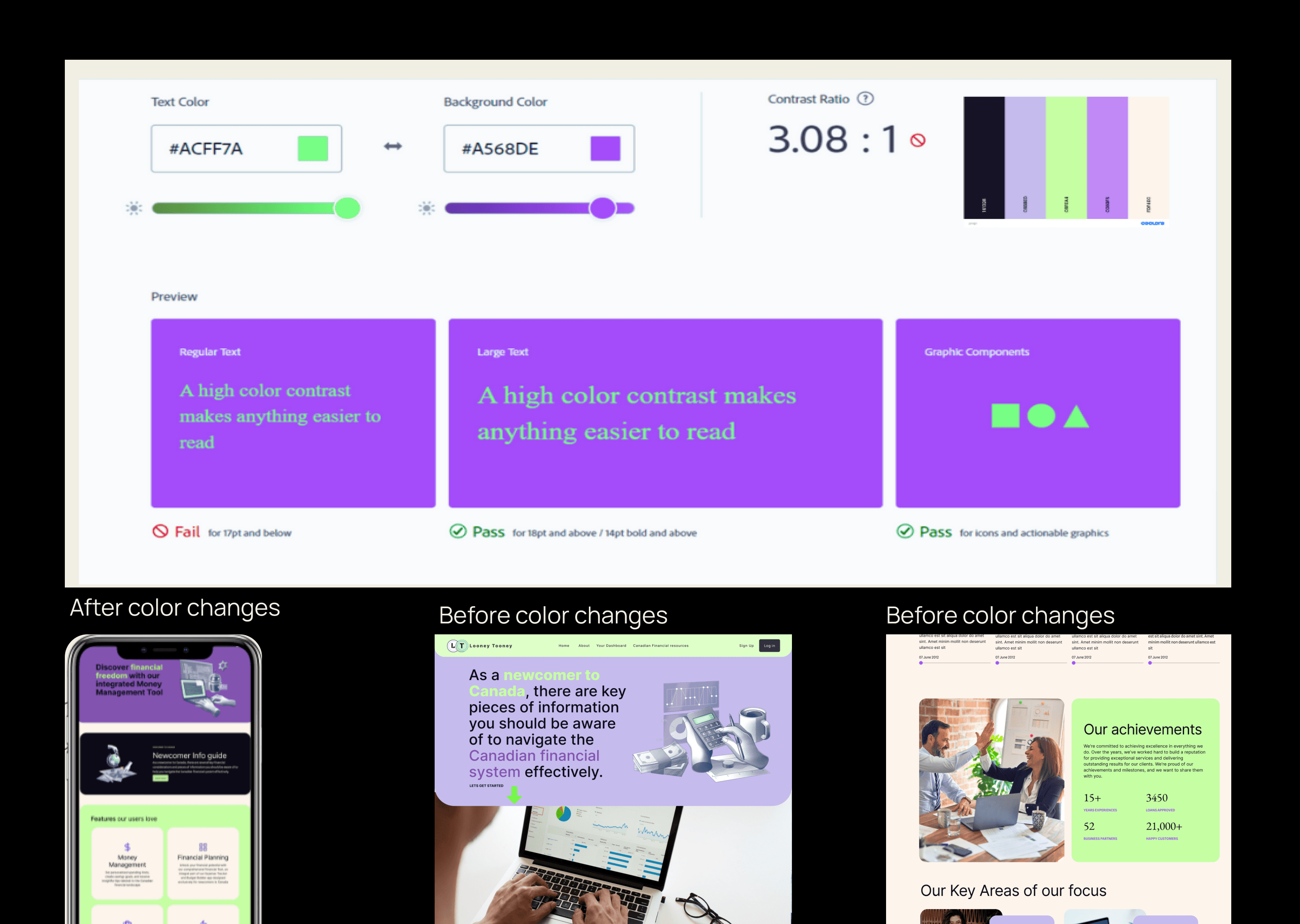

After conducting user tests, I discovered areas where I needed to reassess and strategically consider security measures and governmental policies pertaining to financial systems in Canada. furthermore, after selecting the visual color palette according to the choice of my group, I decided to focus on the accessibility of the UI of our design and lead me to make changes to the high-fidelity mockup This presented several challenges and introduced new dimensions to the design process, as detailed below:

01

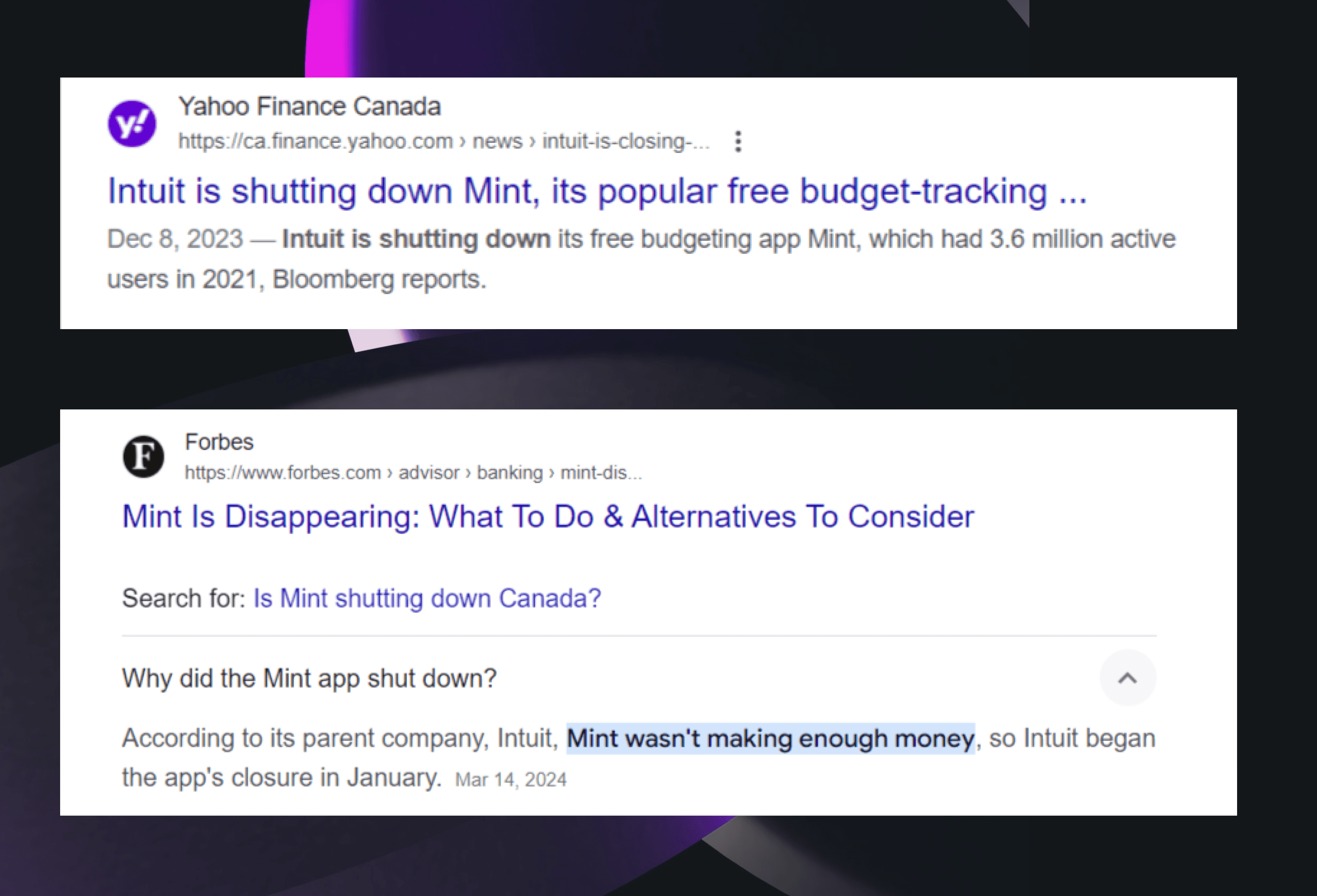

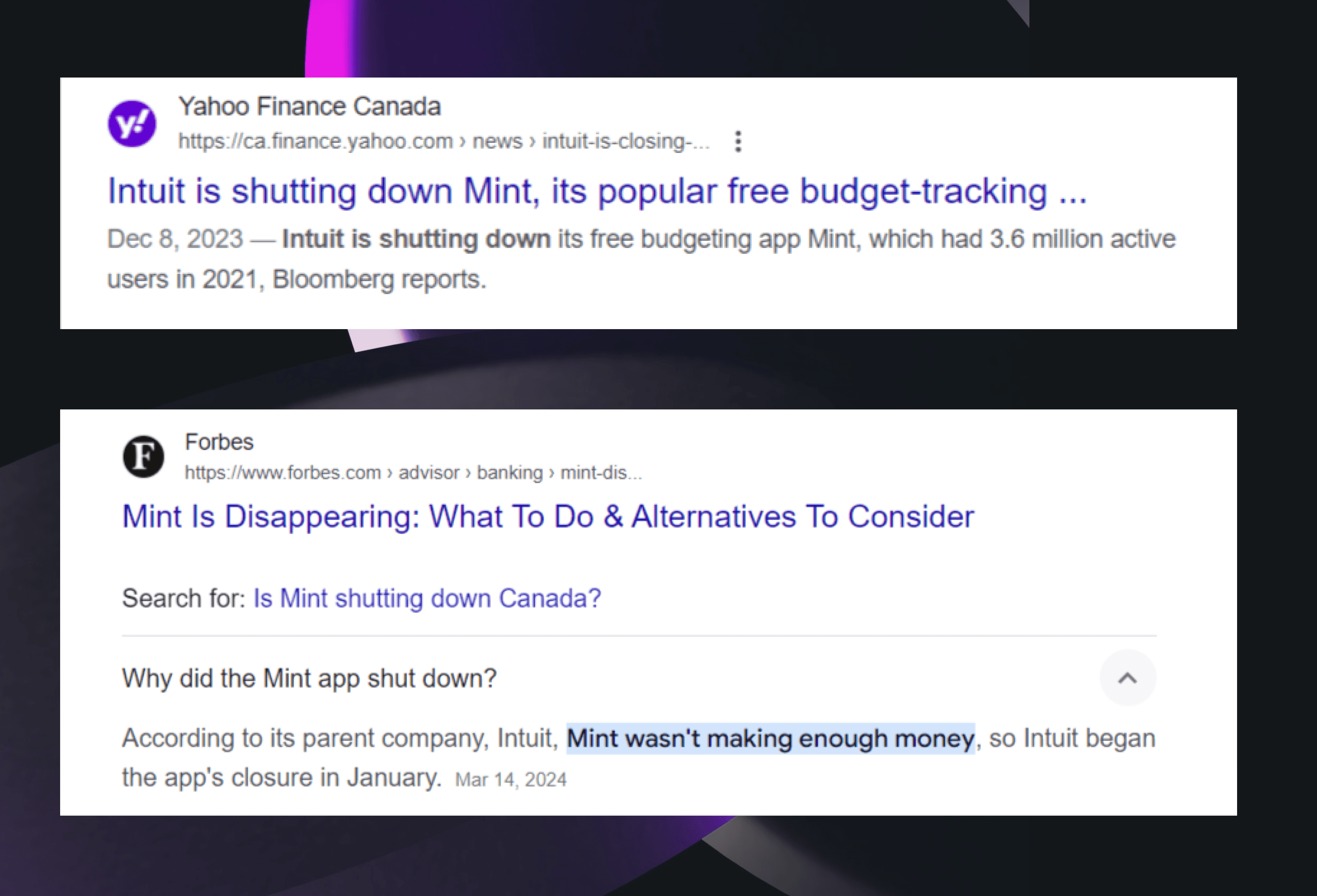

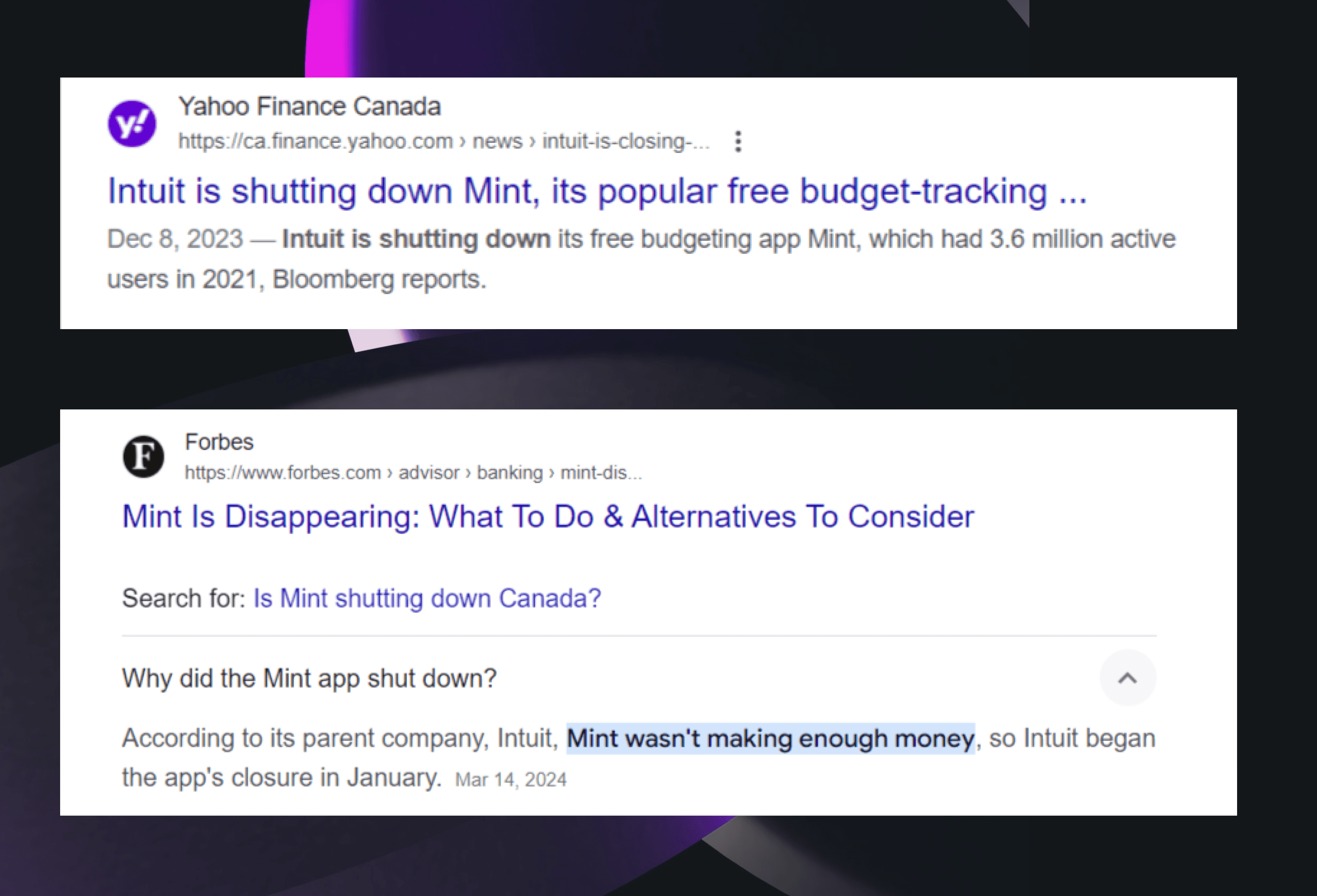

The 'Mint app' was widely embraced by Canadians for managing their expenses. However, its announcement of closure prompted me to reassess the app's structure from a business perspective and Data Privacy Compliance and absence of open banking systems in Canada which posed a significant challenge to the expense tracking. This led me to think of the following as possible solutions :Collaborate with regulatory bodies , real-time data alternatives, manual expense entry , smart receipt scanner, bank transaction import

01

The 'Mint app' was widely embraced by Canadians for managing their expenses. However, its announcement of closure prompted me to reassess the app's structure from a business perspective and Data Privacy Compliance and absence of open banking systems in Canada which posed a significant challenge to the expense tracking. This led me to think of the following as possible solutions :Collaborate with regulatory bodies , real-time data alternatives, manual expense entry , smart receipt scanner, bank transaction import

01

The 'Mint app' was widely embraced by Canadians for managing their expenses. However, its announcement of closure prompted me to reassess the app's structure from a business perspective and Data Privacy Compliance and absence of open banking systems in Canada which posed a significant challenge to the expense tracking. This led me to think of the following as possible solutions :Collaborate with regulatory bodies , real-time data alternatives, manual expense entry , smart receipt scanner, bank transaction import

01

The 'Mint app' was widely embraced by Canadians for managing their expenses. However, its announcement of closure prompted me to reassess the app's structure from a business perspective and Data Privacy Compliance and absence of open banking systems in Canada which posed a significant challenge to the expense tracking. This led me to think of the following as possible solutions :Collaborate with regulatory bodies , real-time data alternatives, manual expense entry , smart receipt scanner, bank transaction import

02

The font size and color choice initially failed to meet accessibility standards. To enhance readability, I aligned them with Google Accessibility color test results. Additionally, to ensure inclusivity for diverse audiences with varying native languages, I implemented multilingual support within the app. The typeface and geometric simplicity were selected to adhere to accessibility standards.

02

The font size and color choice initially failed to meet accessibility standards. To enhance readability, I aligned them with Google Accessibility color test results. Additionally, to ensure inclusivity for diverse audiences with varying native languages, I implemented multilingual support within the app. The typeface and geometric simplicity were selected to adhere to accessibility standards.

02

The font size and color choice initially failed to meet accessibility standards. To enhance readability, I aligned them with Google Accessibility color test results. Additionally, to ensure inclusivity for diverse audiences with varying native languages, I implemented multilingual support within the app. The typeface and geometric simplicity were selected to adhere to accessibility standards.

02

The font size and color choice initially failed to meet accessibility standards. To enhance readability, I aligned them with Google Accessibility color test results. Additionally, to ensure inclusivity for diverse audiences with varying native languages, I implemented multilingual support within the app. The typeface and geometric simplicity were selected to adhere to accessibility standards.

03

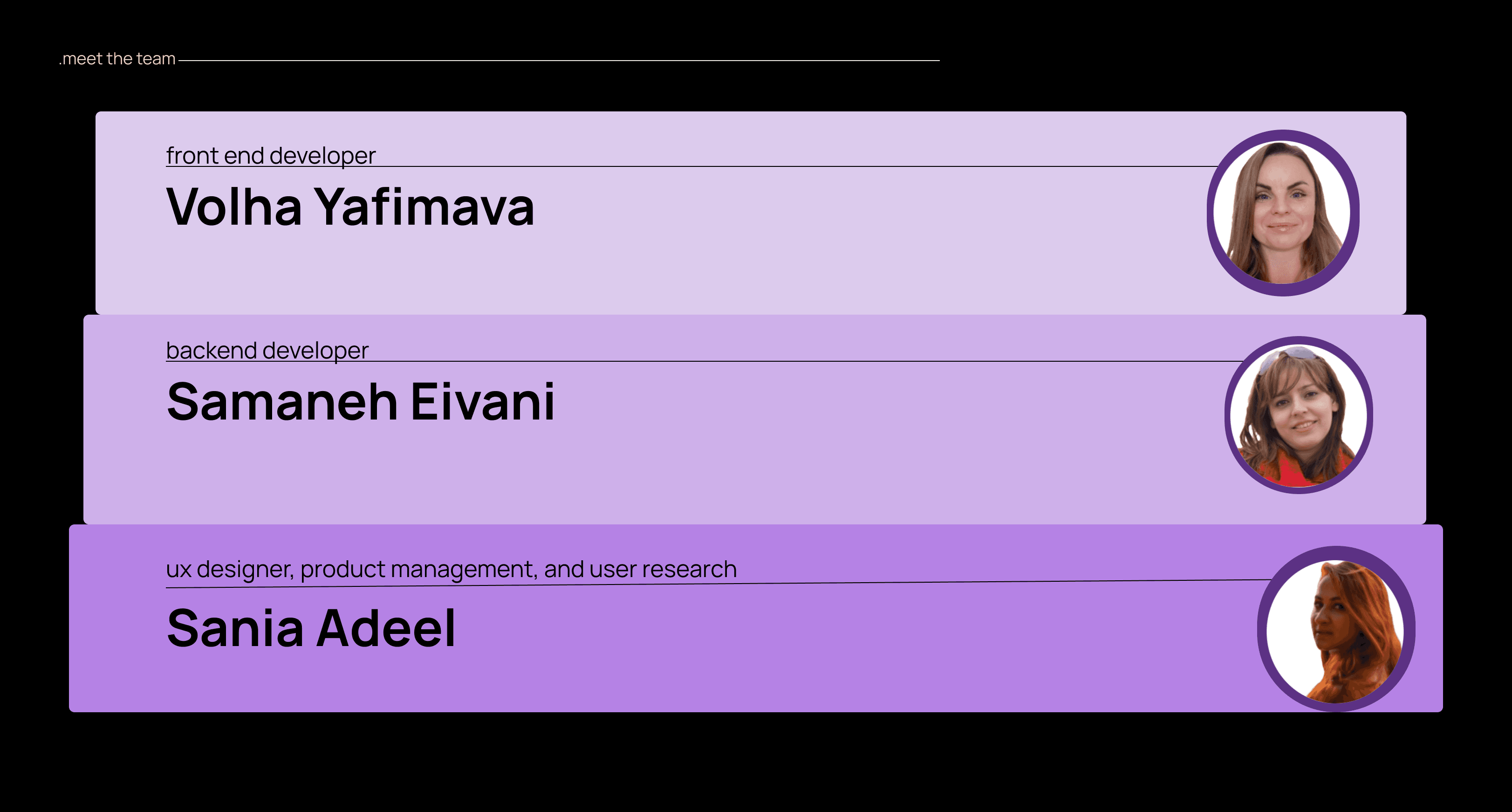

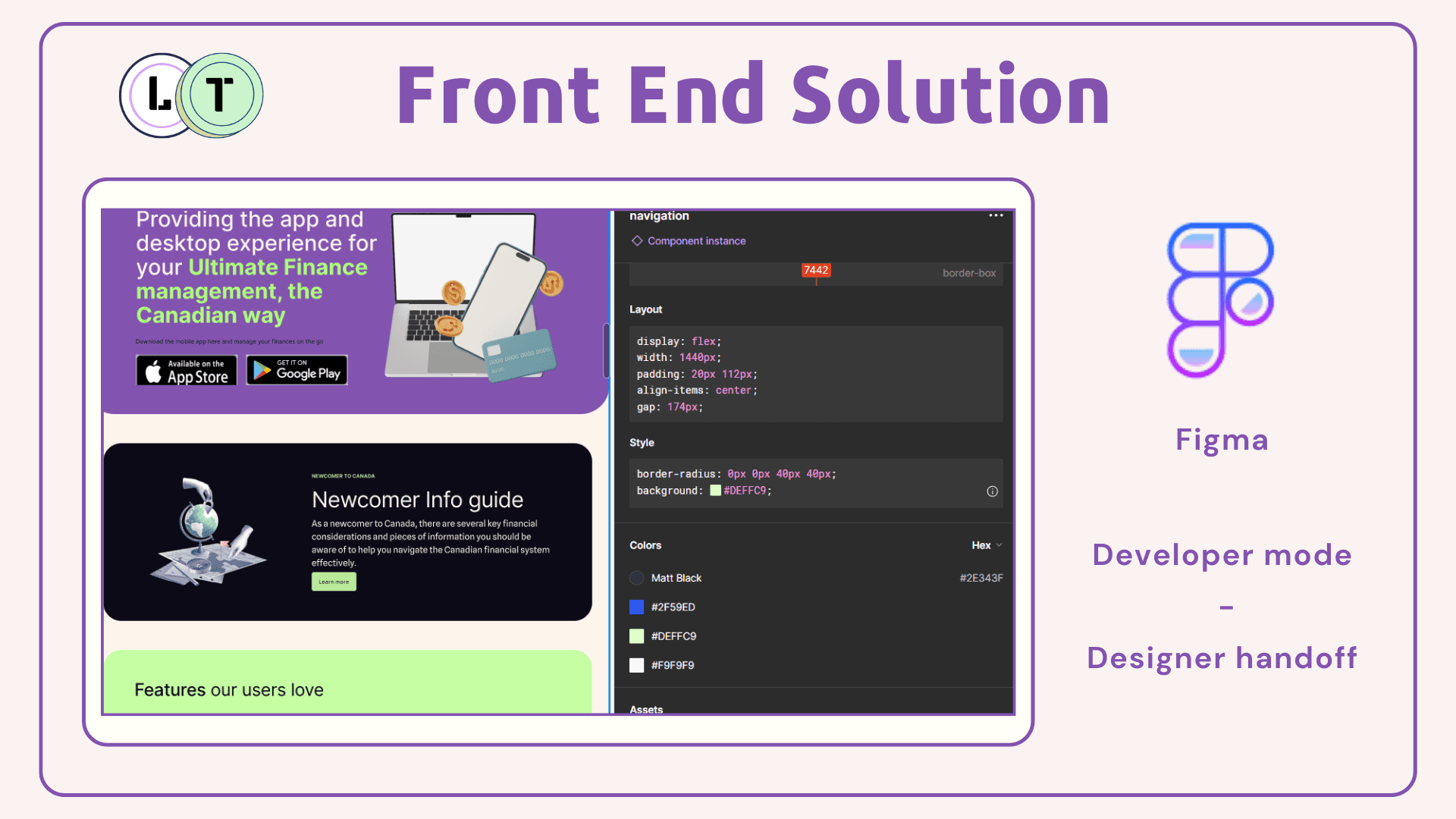

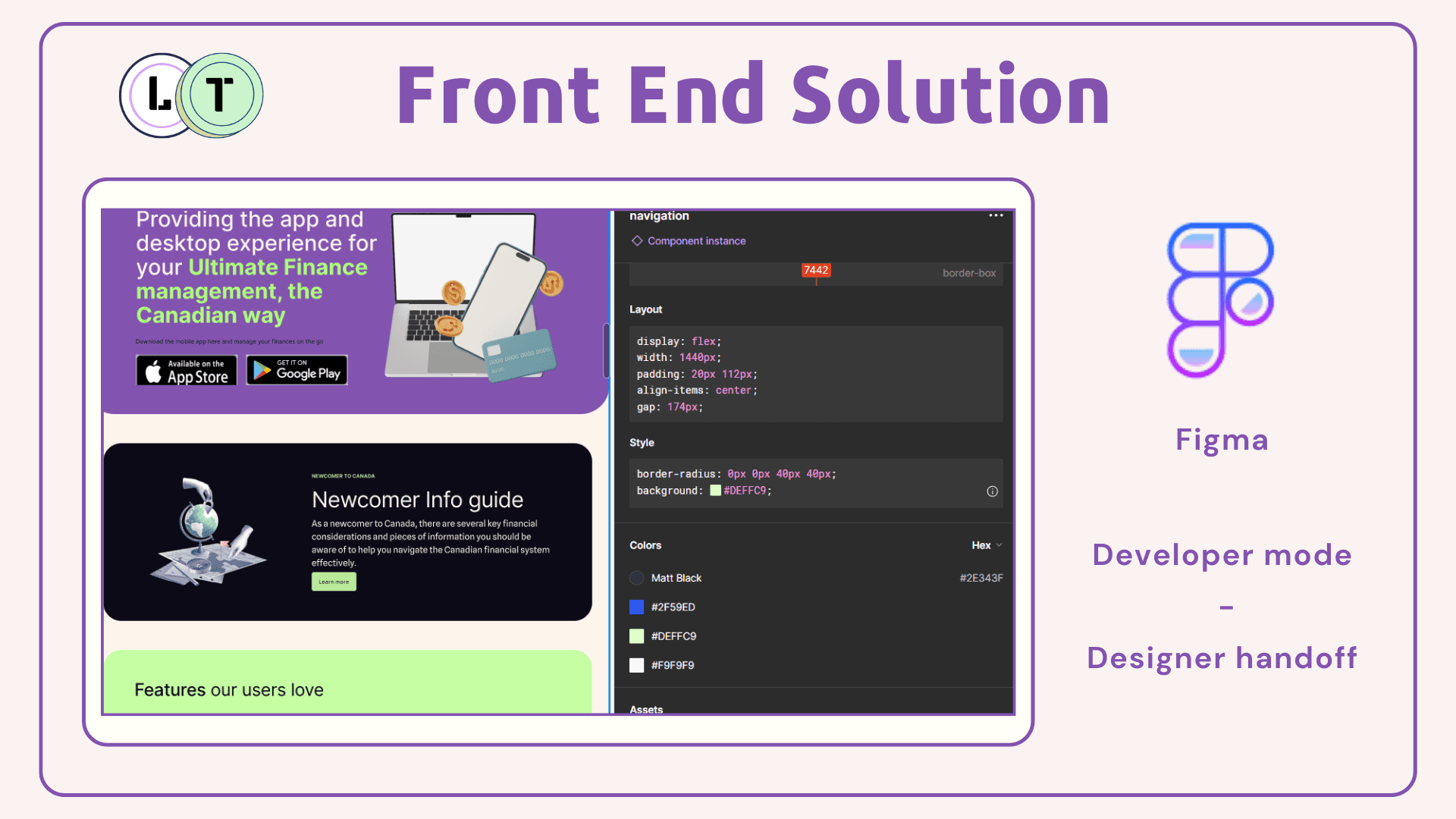

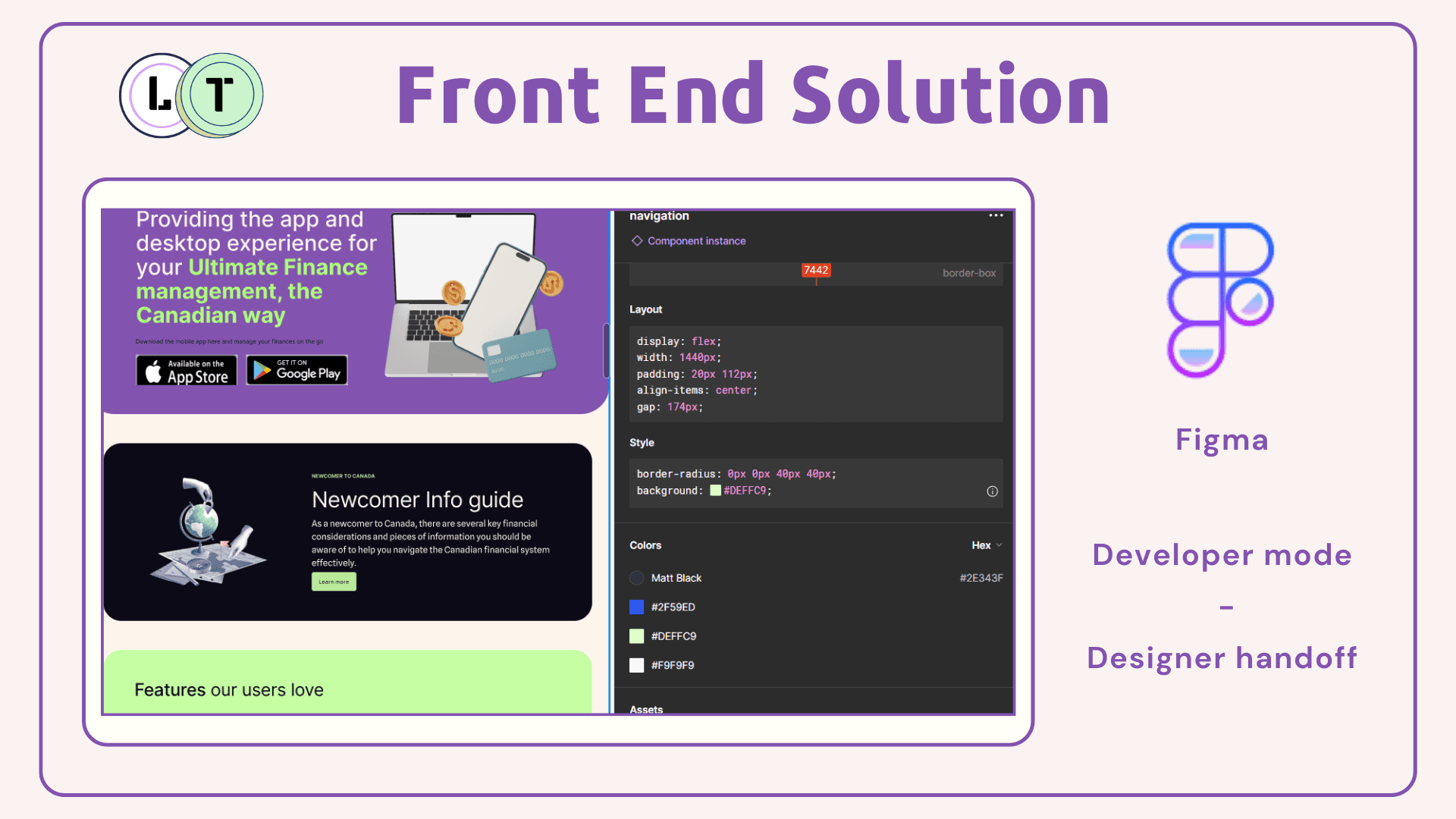

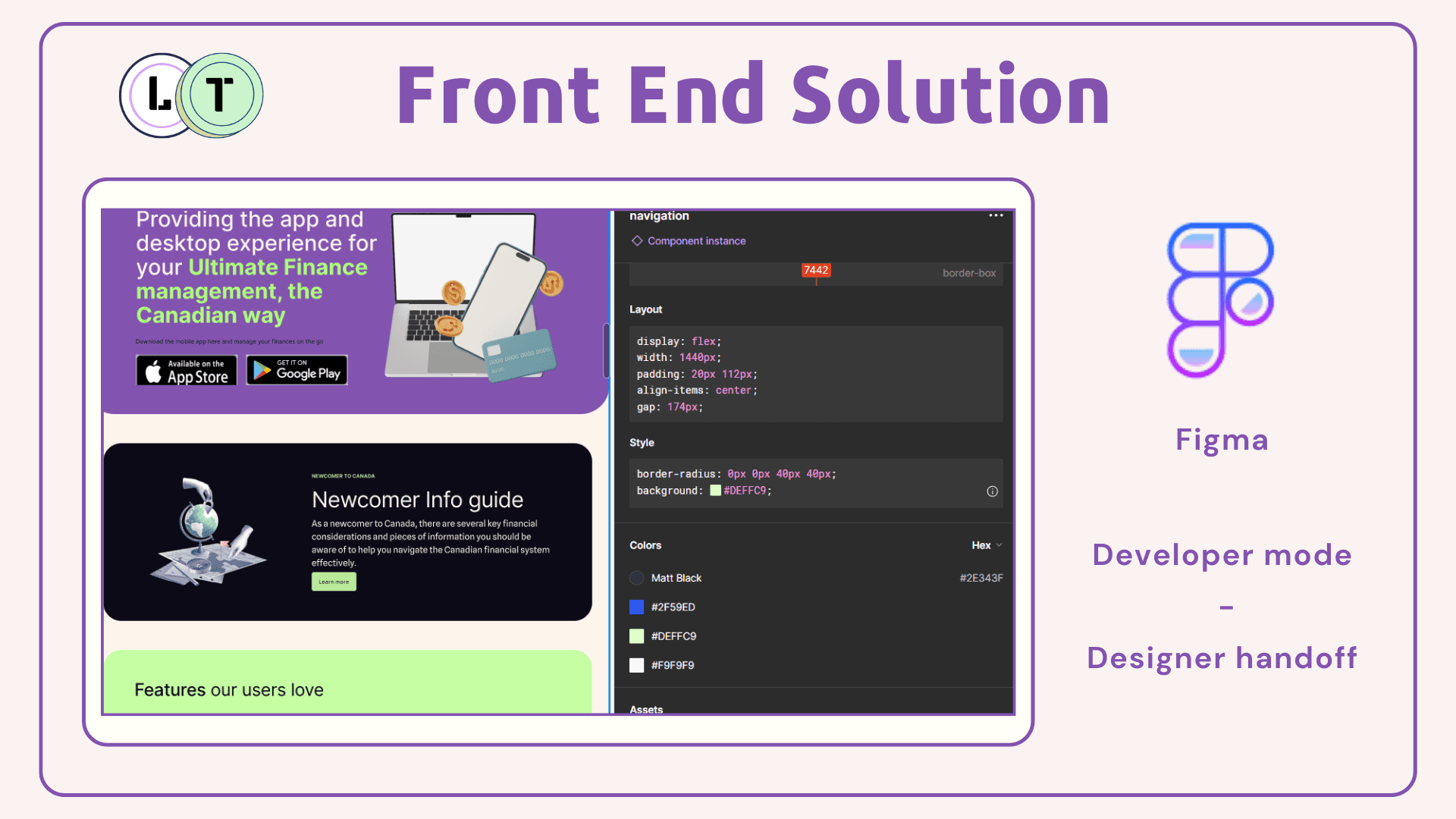

The final stage of design handoff to the front-end developer came in a few challenges since the developerhad not worked with a UX designer before and figma developer mode was a new learning for her. I got the oppertunity to manage the hand-off with an oppertunity to explain Figma developer mode and also working on a style tile and design system together with her.

03

The final stage of design handoff to the front-end developer came in a few challenges since the developerhad not worked with a UX designer before and figma developer mode was a new learning for her. I got the oppertunity to manage the hand-off with an oppertunity to explain Figma developer mode and also working on a style tile and design system together with her.

03

The final stage of design handoff to the front-end developer came in a few challenges since the developerhad not worked with a UX designer before and figma developer mode was a new learning for her. I got the oppertunity to manage the hand-off with an oppertunity to explain Figma developer mode and also working on a style tile and design system together with her.

03

The final stage of design handoff to the front-end developer came in a few challenges since the developerhad not worked with a UX designer before and figma developer mode was a new learning for her. I got the oppertunity to manage the hand-off with an oppertunity to explain Figma developer mode and also working on a style tile and design system together with her.

.say hello

i'm open for freelance projects, full time roles and happy to collaborate, feel free to email me to see how we can make any of these possible

.say hello

i'm open for freelance projects, full time roles and happy to collaborate, feel free to email me to see how we can make any of these possible

.say hello

i'm open for freelance projects, full time roles and happy to collaborate, feel free to email me to see how we can make any of these possible

.say hello